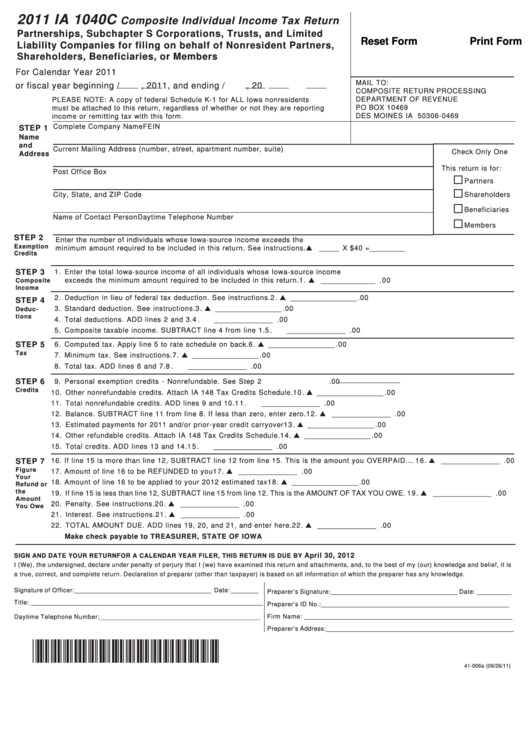

2011 IA 1040C

Composite Individual Income Tax Return

Partnerships, Subchapter S Corporations, Trusts, and Limited

Reset Form

Print Form

Liability Companies for filing on behalf of Nonresident Partners,

Shareholders, Beneficiaries, or Members

For Calendar Year 2011

MAIL TO:

or fiscal year beginning

/

, 2011, and ending

/

, 20

COMPOSITE RETURN PROCESSING

DEPARTMENT OF REVENUE

PLEASE NOTE: A copy of federal Schedule K-1 for ALL Iowa nonresidents

PO BOX 10469

must be attached to this return, regardless of whether or not they are reporting

DES MOINES IA 50306-0469

income or remitting tax with this form.

Complete Company Name

FEIN

STEP 1

Name

and

Current Mailing Address (number, street, apartment number, suite)

Check Only One

Address

This return is for:

Post Office Box

Partners

City, State, and ZIP Code

Shareholders

Beneficiaries

Name of Contact Person

Daytime Telephone Number

Members

STEP 2

Enter the number of individuals whose Iowa-source income exceeds the

Exemption

minimum amount required to be included in this return. See instructions. ............. L _____ X $40 = _________

Credits

STEP 3

1. Enter the total Iowa-source income of all individuals whose Iowa-source income

exceeds the minimum amount required to be included in this return. ............................................................. 1 . L ______________ .00

Composite

Income

2. Deduction in lieu of federal tax deduction. See instructions. ...................... 2 . L _________________ .00

STEP 4

3. Standard deduction. See instructions. .............................................................. 3 . L _________________ .00

Deduc-

tions

4. Total deductions. ADD lines 2 and 3. ..................................................................................................................... 4 .

_______________ .00

5. Composite taxable income. SUBTRACT line 4 from line 1. ............................................................................... 5 .

_______________ .00

6. Computed tax. Apply line 5 to rate schedule on back. .................................. 6 . L _________________ .00

STEP 5

Tax

7. Minimum tax. See instructions. .......................................................................... 7 . L _________________ .00

8. Total tax. ADD lines 6 and 7. ................................................................................................................................. 8 .

_______________ .00

STEP 6

9. Personal exemption credits - Nonrefundable. See Step 2 above..............9.

.00

Credits

10. Other nonrefundable credits. Attach IA 148 Tax Credits Schedule. ......... 10. L _________________ .00

11. Total nonrefundable credits. ADD lines 9 and 10. ............................................................................................. 1 1 .

_______________ .00

12. Balance. SUBTRACT line 11 from line 8. If less than zero, enter zero. ........................................................ 12. L _______________ .00

13. Estimated payments for 2011 and/or prior-year credit carryover .............. 13. L _________________ .00

14. Other refundable credits. Attach IA 148 Tax Credits Schedule. ............... 14. L _________________ .00

15. Total credits. ADD lines 13 and 14. ...................................................................................................................... 1 5 .

_______________ .00

16. If line 15 is more than line 12, SUBTRACT line 12 from line 15. This is the amount you OVERPAID. ... 16. L _______________ .00

STEP 7

Figure

17. Amount of line 16 to be REFUNDED to you ......................................................................................................... 17. L _______________ .00

Your

18. Amount of line 16 to be applied to your 2012 estimated tax ...................... 18. L _________________ .00

Refund or

the

19. If line 15 is less than line 12, SUBTRACT line 15 from line 12. This is the AMOUNT OF TAX YOU OWE. .... 19. L _______________ .00

Amount

20. Penalty. See instructions. ....................................................................................................................................... 20. L _______________ .00

You Owe

21. Interest. See instructions. ....................................................................................................................................... 21. L _______________ .00

22. TOTAL AMOUNT DUE. ADD lines 19, 20, and 21, and enter here. ............................................................... 22. L _______________ .00

Make check payable to TREASURER, STATE OF IOWA

April 30, 2012

SIGN AND DATE YOUR RETURN

FOR A CALENDAR YEAR FILER, THIS RETURN IS DUE BY

I (We), the undersigned, declare under penalty of perjury that I (we) have examined this return and attachments, and, to the best of my (our) knowledge and belief, it is

a true, correct, and complete return. Declaration of preparer (other than taxpayer) is based on all information of which the preparer has any knowledge.

Signature of Officer: ________________________________________ Date: ________

Preparer’s Signature: _____________________________________ Date: __________

Title: ____________________________________________________________________

Preparer’s ID No.: _______________________________________________________

Daytime Telephone Number: _______________________________________________

Firm Name: _____________________________________________________________

Preparer’s Address: _______________________________________________________

*1141001019999*

41-006a (09/26/11)

1

1 2

2