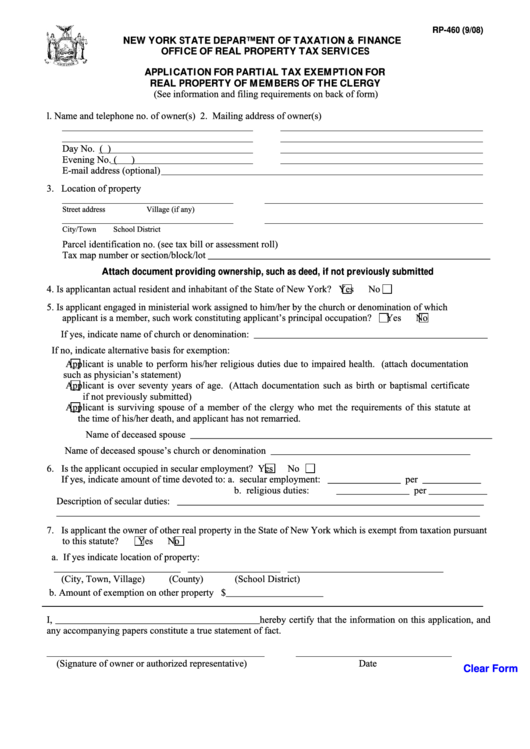

RP-460 (9/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR PARTIAL TAX EXEMPTION FOR

REAL PROPERTY OF MEMBERS OF THE CLERGY

(See information and filing requirements on back of form)

l.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property

Street address

Village (if any)

City/Town

School District

Parcel identification no. (see tax bill or assessment roll)

Tax map number or section/block/lot __________________________________________________________

Attach document providing ownership, such as deed, if not previously submitted

4. Is applicant an actual resident and inhabitant of the State of New York?

Yes

No

5. Is applicant engaged in ministerial work assigned to him/her by the church or denomination of which

applicant is a member, such work constituting applicant’s principal occupation?

Yes

No

If yes, indicate name of church or denomination: ________________________________________________

If no, indicate alternative basis for exemption:

Applicant is unable to perform his/her religious duties due to impaired health. (attach documentation

such as physician’s statement)

Applicant i s ov er seventy y ears o f ag e. ( Attach documentation such as birth o r baptismal c ertificate

if not previously submitted)

Applicant i s s urviving spo use of a m ember of t he clergy w ho met t he requirements of this statute at

the time of his/her death, and applicant has not remarried.

Name of deceased spouse ______________________________________________________________

Name of deceased spouse’s church or denomination _________________________________________

6. Is the applicant occupied in secular employment?

Yes

No

If yes, indicate amount of time devoted to: a. secular employment: _______________ per ____________

b. religious duties:

_______________ per ____________

Description of secular duties: _______________________________________________________________

_______________________________________________________________________________________

7. Is applicant the owner of other real property in the State of New York which is exempt from taxation pursuant

to this statute?

Yes

No

a. If yes indicate location of property:

__________________________

___________________

________________________________

(City, Town, Village)

(County)

(School District)

b. Amount of exemption on other property $____________________

I, __________________________________________hereby certify that the information on t his application, and

any accompanying papers constitute a true statement of fact.

(Signature of owner or authorized representative)

Date

Clear Form

1

1 2

2