Form Au-462 - Vessel Worksheet

Download a blank fillable Form Au-462 - Vessel Worksheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Au-462 - Vessel Worksheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

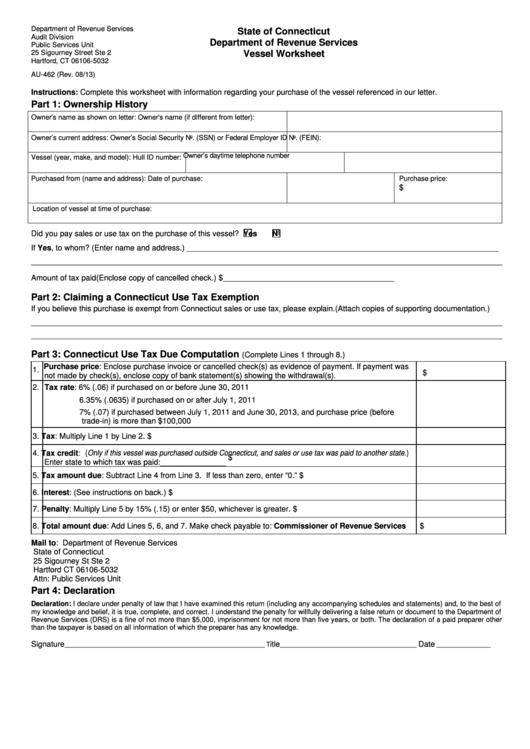

Department of Revenue Services

State of Connecticut

Audit Division

Department of Revenue Services

Public Services Unit

25 Sigourney Street Ste 2

Vessel Worksheet

Hartford, CT 06106-5032

AU-462 (Rev. 08/13)

Instructions: Complete this worksheet with information regarding your purchase of the vessel referenced in our letter.

Part 1: Ownership History

Owner's name as shown on letter:

Owner's name (if different from letter):

Owner’s current address:

Owner’s Social Security No. (SSN) or Federal Employer ID No. (FEIN):

Owner’s daytime telephone number

Vessel (year, make, and model):

Hull ID number:

Purchased from (name and address):

Date of purchase:

Purchase price:

$

Location of vessel at time of purchase:

Did you pay sales or use tax on the purchase of this vessel?

Yes

No

If Yes, to whom? (Enter name and address.)

________________________________________________________________________________

_________________________________________________________________________________________________________________________

Amount of tax paid (Enclose copy of cancelled check.) $

____________________________________________

Part 2: Claiming a Connecticut Use Tax Exemption

If you believe this purchase is exempt from Connecticut sales or use tax, please explain. (Attach copies of supporting documentation.)

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Part 3: Connecticut Use Tax Due Computation

(Complete Lines 1 through 8.)

1. Purchase price: Enclose purchase invoice or cancelled check(s) as evidence of payment. If payment was

$

not made by check(s), enclose copy of bank statement(s) showing the withdrawal(s).

2. Tax rate: 6% (.06) if purchased on or before June 30, 2011

6.35% (.0635) if purchased on or after July 1, 2011

7% (.07) if purchased between July 1, 2011 and June 30, 2013, and purchase price (before

trade-in) is more than $100,000

3. Tax: Multiply Line 1 by Line 2.

$

4. Tax credit: (Only if this vessel was purchased outside Connecticut, and sales or use tax was paid to another state.)

$

Enter state to which tax was paid:_______________

5. Tax amount due: Subtract Line 4 from Line 3. If less than zero, enter “0.”

$

6. Interest: (See instructions on back.)

$

7. Penalty: Multiply Line 5 by 15% (.15) or enter $50, whichever is greater.

$

8. Total amount due: Add Lines 5, 6, and 7. Make check payable to: Commissioner of Revenue Services

$

Mail to: Department of Revenue Services

State of Connecticut

25 Sigourney St Ste 2

Hartford CT 06106-5032

Attn: Public Services Unit

Part 4: Declaration

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of

Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

_______________________________________________________________ T

___________________________________________

_________________

Signature

itle

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2