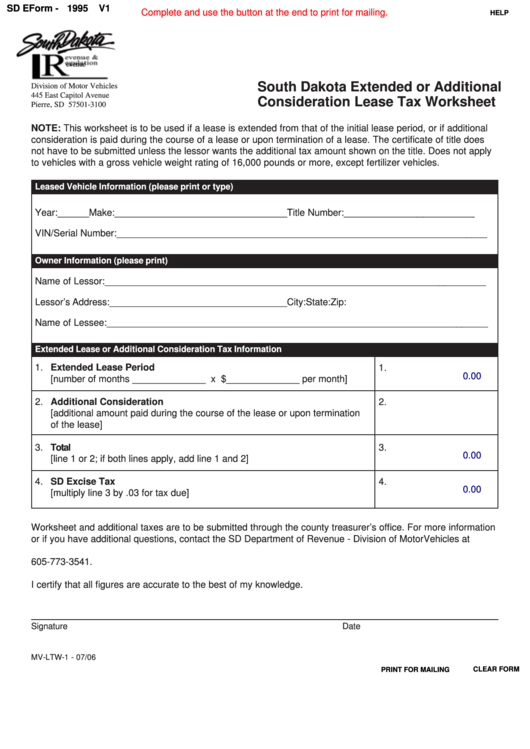

SD EForm -

1995

V1

Complete and use the button at the end to print for mailing.

HELP

evenue

South Dakota Extended or Additional

Division of Motor Vehicles

445 East Capitol Avenue

Consideration Lease Tax Worksheet

Pierre, SD 57501-3100

NOTE: This worksheet is to be used if a lease is extended from that of the initial lease period, or if additional

consideration is paid during the course of a lease or upon termination of a lease. The certificate of title does

not have to be submitted unless the lessor wants the additional tax amount shown on the title. Does not apply

to vehicles with a gross vehicle weight rating of 16,000 pounds or more, except fertilizer vehicles.

Leased Vehicle Information (please print or type)

Year: ______ Make: _________________________________Title Number: _________________________

VIN/Serial Number: _______________________________________________________________________

Owner Information (please print)

Name of Lessor: _________________________________________________________________________

Lessor’s Address:__________________________________City:

State:

Zip:

Name of Lessee: _________________________________________________________________________

Extended Lease or Additional Consideration Tax Information

1. Extended Lease Period

1.

0.00

[number of months ______________ x $______________ per month]

2. Additional Consideration

2.

[additional amount paid during the course of the lease or upon termination

of the lease]

3. Total

3.

0.00

[line 1 or 2; if both lines apply, add line 1 and 2]

4. SD Excise Tax

4.

0.00

[multiply line 3 by .03 for tax due]

Worksheet and additional taxes are to be submitted through the county treasurer’s office. For more information

or if you have additional questions, contact the SD Department of Revenue - Division of Motor Vehicles at

605-773-3541.

I certify that all figures are accurate to the best of my knowledge.

Signature

Date

MV-LTW-1 - 07/06

CLEAR FORM

PRINT FOR MAILING

1

1