Instructions For Form P-64a And Form P-64b - To Pay The Conveyance Tax/to Request An Exemption From The Conveyance Tax

ADVERTISEMENT

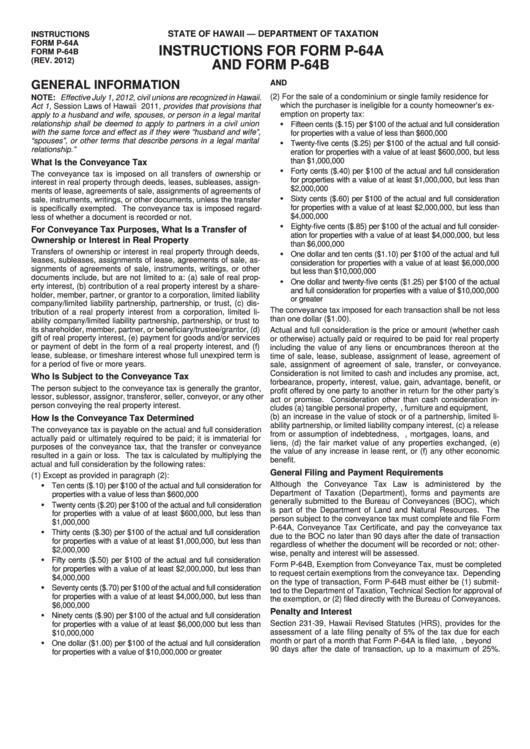

INSTRUCTIONS

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM P-64A

INSTRUCTIONS FOR FORM P-64A

FORM P-64B

(REV. 2012)

AND FORM P-64B

AND

GENERAL INFORMATION

(2) For the sale of a condominium or single family residence for

NOTE: Effective July 1, 2012, civil unions are recognized in Hawaii.

which the purchaser is ineligible for a county homeowner’s ex-

Act 1, Session Laws of Hawaii 2011, provides that provisions that

emption on property tax:

apply to a husband and wife, spouses, or person in a legal marital

• Fifteen cents ($.15) per $100 of the actual and full consideration

relationship shall be deemed to apply to partners in a civil union

with the same force and effect as if they were “husband and wife”,

for properties with a value of less than $600,000

“spouses”, or other terms that describe persons in a legal marital

• Twenty-five cents ($.25) per $100 of the actual and full consid-

relationship.”

eration for properties with a value of at least $600,000, but less

than $1,000,000

What Is the Conveyance Tax

• Forty cents ($.40) per $100 of the actual and full consideration

The conveyance tax is imposed on all transfers of ownership or

for properties with a value of at least $1,000,000, but less than

interest in real property through deeds, leases, subleases, assign-

$2,000,000

ments of lease, agreements of sale, assignments of agreements of

• Sixty cents ($.60) per $100 of the actual and full consideration

sale, instruments, writings, or other documents, unless the transfer

for properties with a value of at least $2,000,000, but less than

is specifically exempted. The conveyance tax is imposed regard-

$4,000,000

less of whether a document is recorded or not.

• Eighty-five cents ($.85) per $100 of the actual and full consider-

For Conveyance Tax Purposes, What Is a Transfer of

ation for properties with a value of at least $4,000,000, but less

Ownership or Interest in Real Property

than $6,000,000

Transfers of ownership or interest in real property through deeds,

• One dollar and ten cents ($1.10) per $100 of the actual and full

leases, subleases, assignments of lease, agreements of sale, as-

consideration for properties with a value of at least $6,000,000

signments of agreements of sale, instruments, writings, or other

but less than $10,000,000

documents include, but are not limited to a: (a) sale of real prop-

• One dollar and twenty-five cents ($1.25) per $100 of the actual

erty interest, (b) contribution of a real property interest by a share-

and full consideration for properties with a value of $10,000,000

holder, member, partner, or grantor to a corporation, limited liability

or greater

company/limited liability partnership, partnership, or trust, (c) dis-

The conveyance tax imposed for each transaction shall be not less

tribution of a real property interest from a corporation, limited li-

than one dollar ($1.00).

ability company/limited liability partnership, partnership, or trust to

its shareholder, member, partner, or beneficiary/trustee/grantor, (d)

Actual and full consideration is the price or amount (whether cash

gift of real property interest, (e) payment for goods and/or services

or otherwise) actually paid or required to be paid for real property

or payment of debt in the form of a real property interest, and (f)

including the value of any liens or encumbrances thereon at the

lease, sublease, or timeshare interest whose full unexpired term is

time of sale, lease, sublease, assignment of lease, agreement of

for a period of five or more years.

sale, assignment of agreement of sale, transfer, or conveyance.

Consideration is not limited to cash and includes any promise, act,

Who Is Subject to the Conveyance Tax

forbearance, property, interest, value, gain, advantage, benefit, or

The person subject to the conveyance tax is generally the grantor,

profit offered by one party to another in return for the other party’s

lessor, sublessor, assignor, transferor, seller, conveyor, or any other

act or promise. Consideration other than cash consideration in-

person conveying the real property interest.

cludes (a) tangible personal property, e.g., furniture and equipment,

(b) an increase in the value of stock or of a partnership, limited li-

How Is the Conveyance Tax Determined

ability partnership, or limited liability company interest, (c) a release

The conveyance tax is payable on the actual and full consideration

from or assumption of indebtedness, e.g., mortgages, loans, and

actually paid or ultimately required to be paid; it is immaterial for

liens, (d) the fair market value of any properties exchanged, (e)

purposes of the conveyance tax, that the transfer or conveyance

the value of any increase in lease rent, or (f) any other economic

resulted in a gain or loss. The tax is calculated by multiplying the

benefit.

actual and full consideration by the following rates:

General Filing and Payment Requirements

(1) Except as provided in paragraph (2):

Although the Conveyance Tax Law is administered by the

• Ten cents ($.10) per $100 of the actual and full consideration for

Department of Taxation (Department), forms and payments are

properties with a value of less than $600,000

generally submitted to the Bureau of Conveyances (BOC), which

• Twenty cents ($.20) per $100 of the actual and full consideration

is part of the Department of Land and Natural Resources. The

for properties with a value of at least $600,000, but less than

person subject to the conveyance tax must complete and file Form

$1,000,000

P-64A, Conveyance Tax Certificate, and pay the conveyance tax

• Thirty cents ($.30) per $100 of the actual and full consideration

due to the BOC no later than 90 days after the date of transaction

for properties with a value of at least $1,000,000, but less than

regardless of whether the document will be recorded or not; other-

$2,000,000

wise, penalty and interest will be assessed.

• Fifty cents ($.50) per $100 of the actual and full consideration

Form P-64B, Exemption from Conveyance Tax, must be completed

for properties with a value of at least $2,000,000, but less than

to request certain exemptions from the conveyance tax. Depending

$4,000,000

on the type of transaction, Form P-64B must either be (1) submit-

• Seventy cents ($.70) per $100 of the actual and full consideration

ted to the Department of Taxation, Technical Section for approval of

for properties with a value of at least $4,000,000, but less than

the exemption, or (2) filed directly with the Bureau of Conveyances.

$6,000,000

Penalty and Interest

• Ninety cents ($.90) per $100 of the actual and full consideration

Section 231-39, Hawaii Revised Statutes (HRS), provides for the

for properties with a value of at least $6,000,000 but less than

assessment of a late filing penalty of 5% of the tax due for each

$10,000,000

month or part of a month that Form P-64A is filed late, i.e., beyond

• One dollar ($1.00) per $100 of the actual and full consideration

90 days after the date of transaction, up to a maximum of 25%.

for properties with a value of $10,000,000 or greater

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4