Instructions For Form Ta-40 - Transient Accommodations Tax Time Share Occupancy Registration

ADVERTISEMENT

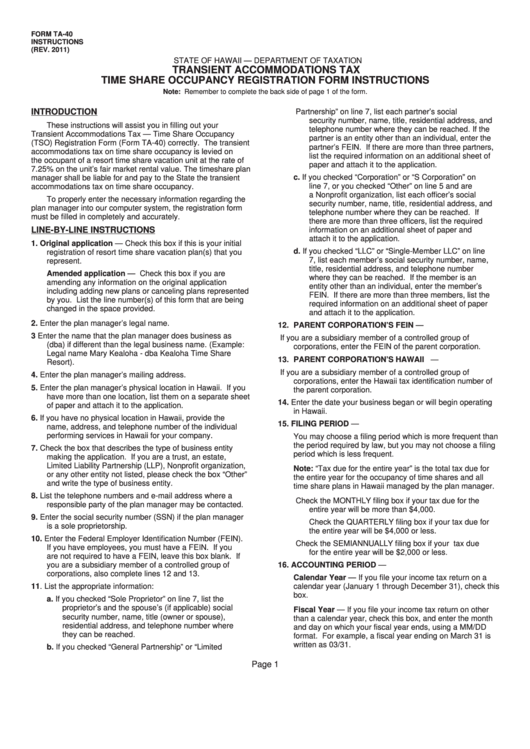

FORM TA-40

INSTRUCTIONS

(REV. 2011)

STATE OF HAWAII — DEPARTMENT OF TAXATION

TRANSIENT ACCOMMODATIONS TAX

TIME SHARE OCCUPANCY REGISTRATION FORM INSTRUCTIONS

Note: Remember to complete the back side of page 1 of the form.

INTRODUCTION

Partnership” on line 7, list each partner’s social

security number, name, title, residential address, and

These instructions will assist you in filling out your

telephone number where they can be reached. If the

Transient Accommodations Tax — Time Share Occupancy

partner is an entity other than an individual, enter the

(TSO) Registration Form (Form TA-40) correctly. The transient

partner’s FEIN. If there are more than three partners,

accommodations tax on time share occupancy is levied on

list the required information on an additional sheet of

the occupant of a resort time share vacation unit at the rate of

paper and attach it to the application.

7.25% on the unit’s fair market rental value. The timeshare plan

c.

If you checked “Corporation” or “S Corporation” on

manager shall be liable for and pay to the State the transient

line 7, or you checked “Other” on line 5 and are

accommodations tax on time share occupancy.

a Nonprofit organization, list each officer’s social

To properly enter the necessary information regarding the

security number, name, title, residential address, and

plan manager into our computer system, the registration form

telephone number where they can be reached. If

must be filled in completely and accurately.

there are more than three officers, list the required

LINE-BY-LINE INSTRUCTIONS

information on an additional sheet of paper and

attach it to the application.

1.

Original application — Check this box if this is your initial

d.

If you checked “LLC” or “Single-Member LLC” on line

registration of resort time share vacation plan(s) that you

7, list each member’s social security number, name,

represent.

title, residential address, and telephone number

Amended application — Check this box if you are

where they can be reached. If the member is an

amending any information on the original application

entity other than an individual, enter the member’s

including adding new plans or canceling plans represented

FEIN. If there are more than three members, list the

by you. List the line number(s) of this form that are being

required information on an additional sheet of paper

changed in the space provided.

and attach it to the application.

2.

Enter the plan manager’s legal name.

12. PARENT CORPORATION’S FEIN —

3

Enter the name that the plan manager does business as

If you are a subsidiary member of a controlled group of

(dba) if different than the legal business name. (Example:

corporations, enter the FEIN of the parent corporation.

Legal name Mary Kealoha - dba Kealoha Time Share

13. PARENT CORPORATION’S HAWAII I.D. NO. —

Resort).

If you are a subsidiary member of a controlled group of

4.

Enter the plan manager’s mailing address.

corporations, enter the Hawaii tax identification number of

5.

Enter the plan manager’s physical location in Hawaii. If you

the parent corporation.

have more than one location, list them on a separate sheet

14. Enter the date your business began or will begin operating

of paper and attach it to the application.

in Hawaii.

6.

If you have no physical location in Hawaii, provide the

15. FILING PERIOD —

name, address, and telephone number of the individual

performing services in Hawaii for your company.

You may choose a filing period which is more frequent than

the period required by law, but you may not choose a filing

7.

Check the box that describes the type of business entity

period which is less frequent.

making the application. If you are a trust, an estate,

Limited Liability Partnership (LLP), Nonprofit organization,

Note: “Tax due for the entire year” is the total tax due for

or any other entity not listed, please check the box “Other”

the entire year for the occupancy of time shares and all

and write the type of business entity.

time share plans in Hawaii managed by the plan manager.

8.

List the telephone numbers and e-mail address where a

Check the MONTHLY filing box if your tax due for the

responsible party of the plan manager may be contacted.

entire year will be more than $4,000.

9.

Enter the social security number (SSN) if the plan manager

Check the QUARTERLY filing box if your tax due for

is a sole proprietorship.

the entire year will be $4,000 or less.

10. Enter the Federal Employer Identification Number (FEIN).

Check the SEMIANNUALLY filing box if your tax due

If you have employees, you must have a FEIN. If you

for the entire year will be $2,000 or less.

are not required to have a FEIN, leave this box blank. If

you are a subsidiary member of a controlled group of

16. ACCOUNTING PERIOD —

corporations, also complete lines 12 and 13.

Calendar Year — If you file your income tax return on a

11. List the appropriate information:

calendar year (January 1 through December 31), check this

box.

a.

If you checked “Sole Proprietor” on line 7, list the

proprietor’s and the spouse’s (if applicable) social

Fiscal Year — If you file your income tax return on other

security number, name, title (owner or spouse),

than a calendar year, check this box, and enter the month

residential address, and telephone number where

and day on which your fiscal year ends, using a MM/DD

they can be reached.

format. For example, a fiscal year ending on March 31 is

written as 03/31.

b.

If you checked “General Partnership” or “Limited

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2