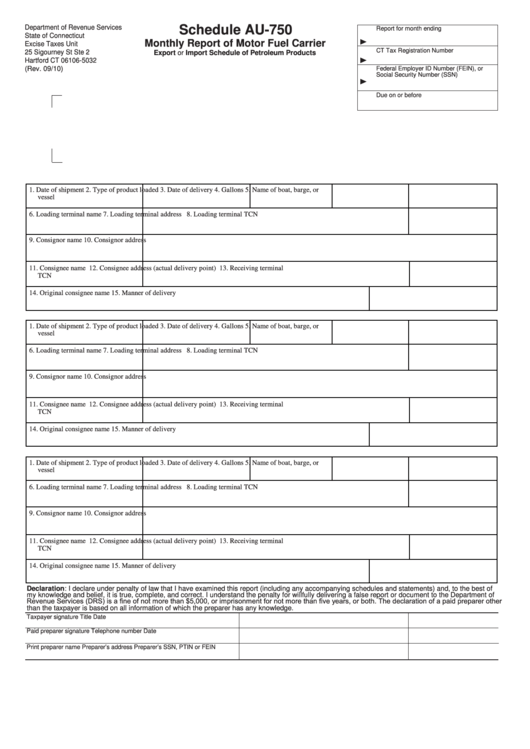

Schedule AU-750

Department of Revenue Services

Report for month ending

State of Connecticut

Monthly Report of Motor Fuel Carrier

Excise Taxes Unit

CT Tax Registration Number

25 Sigourney St Ste 2

Export or Import Schedule of Petroleum Products

Hartford CT 06106-5032

(Rev. 09/10)

Federal Employer ID Number (FEIN), or

Social Security Number (SSN)

Due on or before

1. Date of shipment

2. Type of product loaded

3. Date of delivery

4. Gallons

5. Name of boat, barge, or

vessel

6. Loading terminal name

7. Loading terminal address

8. Loading terminal TCN

9. Consignor name

10. Consignor address

11. Consignee name

12. Consignee address (actual delivery point)

13. Receiving terminal

TCN

14. Original consignee name

15. Manner of delivery

1. Date of shipment

2. Type of product loaded

3. Date of delivery

4. Gallons

5. Name of boat, barge, or

vessel

6. Loading terminal name

7. Loading terminal address

8. Loading terminal TCN

9. Consignor name

10. Consignor address

11. Consignee name

12. Consignee address (actual delivery point)

13. Receiving terminal

TCN

14. Original consignee name

15. Manner of delivery

1. Date of shipment

2. Type of product loaded

3. Date of delivery

4. Gallons

5. Name of boat, barge, or

vessel

6. Loading terminal name

7. Loading terminal address

8. Loading terminal TCN

9. Consignor name

10. Consignor address

11. Consignee name

12. Consignee address (actual delivery point)

13. Receiving terminal

TCN

14. Original consignee name

15. Manner of delivery

Declaration: I declare under penalty of law that I have examined this report (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false report or document to the Department of

Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer signature

Title

Date

Paid preparer signature

Telephone number

Date

Print preparer name

Preparer’s address

Preparer’s SSN, PTIN or FEIN

1

1 2

2