Form Rp-487 - Application For Tax Exemption Of Solar Or Wind Energy Systems Or Farm Waste Energy Systems

ADVERTISEMENT

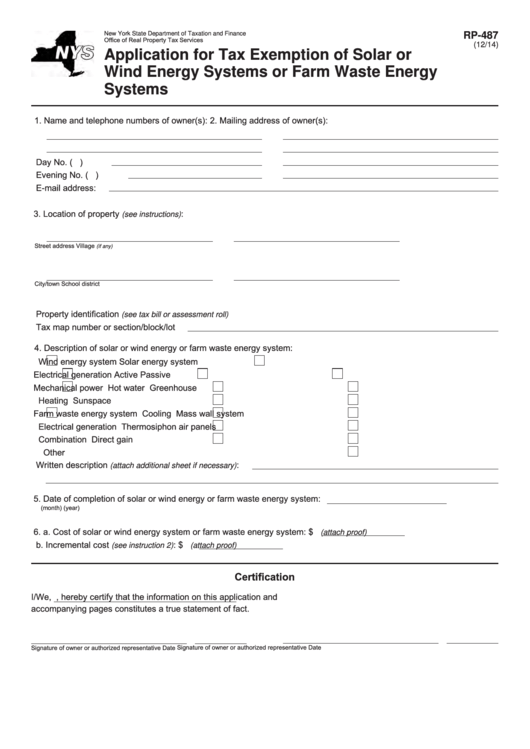

New York State Department of Taxation and Finance

RP-487

Office of Real Property Tax Services

(12/14)

Application for Tax Exemption of Solar or

Wind Energy Systems or Farm Waste Energy

Systems

1. Name and telephone numbers of owner(s):

2. Mailing address of owner(s):

Day No. (

)

Evening No. (

)

E-mail address:

3. Location of property

:

(see instructions)

Street address

Village

(if any)

City/town

School district

Property identification

(see tax bill or assessment roll)

Tax map number or section/block/lot

4. Description of solar or wind energy or farm waste energy system:

Wind energy system

Solar energy system

Electrical generation

Active

Passive

Mechanical power

Hot water

Greenhouse

Heating

Sunspace

Farm waste energy system

Cooling

Mass wall system

Electrical generation

Thermosiphon air panels

Combination

Direct gain

Other

Written description

:

(attach additional sheet if necessary)

5. Date of completion of solar or wind energy or farm waste energy system:

(month)

(year)

6. a. Cost of solar or wind energy system or farm waste energy system: $

(attach proof)

b. Incremental cost

: $

(see instruction 2)

(attach proof)

Certification

I/We,

, hereby certify that the information on this application and

accompanying pages constitutes a true statement of fact.

Signature of owner or authorized representative

Date

Signature of owner or authorized representative

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2