Instructions For Form M-22 - Quarterly Tax Return For Additional Fuel Taxes Due

ADVERTISEMENT

STATE OF HAWAII—DEPARTMENT OF TAXATION

INSTRUCTIONS

INSTRUCTIONS FOR FORM M-22

FORM M-22

(REV. 2013)

QUARTERLY TAX RETURN FOR ADDITIONAL FUEL TAXES DUE

product sold by a distributor to any re-

Where to File

Changes You Should

tail dealer or end user (other than a re-

Note

Mail Form M-22 and your fuel tax pay-

finer) of the petroleum product.

ment to:

Effective July 1, 2013, the County of

Definition of Certain Terms

Hawaii Department of Taxation

Kauai approved Resolution No. 2013-

P.O. Box 259

Used in Chapter 243, HRS

47, Draft 3, which increases the County

Honolulu, Hawaii 96809-0259

of Kauai liquid fuel tax by an additional

“Alternative fuel” means methanol,

2 cents per gallon. The Resolution also

denatured ethanol, and other alcohols;

Where to Get Forms,

increases the County of Kauai liquid

mixtures containing 85 percent or more

Instructions, and Publications

fuel tax by an additional 2 cents per

by volume of methanol, denatured eth-

gallon effective July 1, 2014.

anol, and other alcohols with gasoline

Forms, publications, and other docu-

or other fuels; natural gas; liquefied

ments, such as copies of Tax Infor-

General Instructions

petroleum gas; hydrogen; coal-derived

mation Releases and Administrative

Form M-22 is completed by the pur-

liquid fuels; biodiesel; mixtures con-

Rules issued by the Department, are

chaser of fuel to report and pay any

taining 20 percent or more by volume

available on the Department’s website

additional State license and county fuel

of biodiesel with diesel or other fuels;

at tax.hawaii.gov or you may contact a

taxes due on:

fuels (other than alcohol) derived from

customer service representative at:

1. Diesel oil or alternative fuel

biological materials; and any other fuel

Voice: 808-587-4242

initially purchased for use off

that is substantially not a petroleum

1-800-222-3229 (Toll-Free)

the public highways but subse-

product and that the governor deter-

quently used upon the public

mines would yield a substantial energy

Telephone for the Hearing Impaired:

highways, and

security benefits or substantial environ-

808-587-1418

2. Naphtha initially purchased for

mental benefits.

1-800-887-8974 (Toll-Free)

use in a power-generating facil-

“Power-generating facility” means

Fax:

808-587-1488

ity but subsequently not used in

any electricity-generating facility that

a power-generating facility.

E-mail: Taxpayer.Services@hawaii.gov

requires a permit issued under the

The fuel tax is comprised of three parts,

Federal Clean Air Act (42 U.S.C. 7401-

Mail:

Taxpayer Services Branch

the State license tax, the county fuel

7671q), the Hawaii air pollution control

P.O. Box 259

tax, and the environmental response,

law (chapter 342B, HRS), or both.

Honolulu, HI 96809-0259

energy, and food security tax. The

When to File

amount of the State license tax is set

Signature

by legislation. The county fuel tax var-

Form M-22 must be filed on or before

Form M-22 must be signed and dated

ies by county and is set by county or-

the 20th day of the month following the

by a person who is authorized to sign

dinance. The environmental response,

close of the filing period. If the due date

Form M-22.

energy, and food security tax is $1.05

falls on a Saturday, Sunday, or legal

on each barrel (42 U. S. gallons) or

holiday, file by the next regular work-

fractional part of a barrel of petroleum

day.

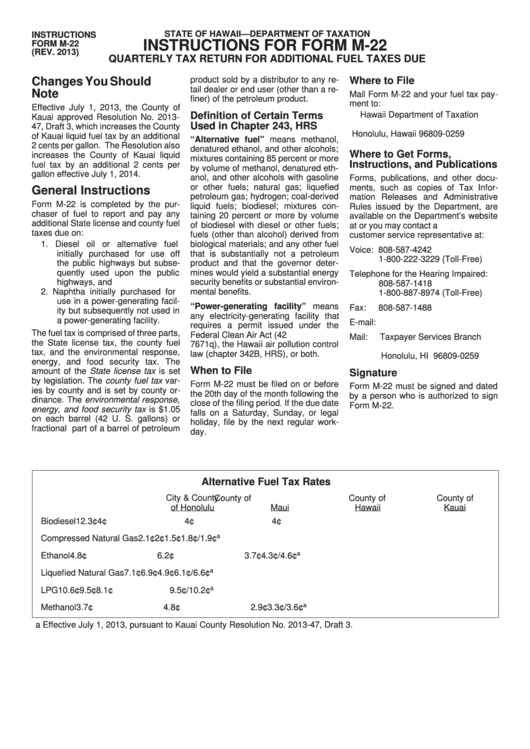

Alternative Fuel Tax Rates

City & County

County of

County of

County of

of Honolulu

Maui

Hawaii

Kauai

Biodiesel

12.3¢

4¢

4¢

4¢

a

Compressed Natural Gas

2.1¢

2¢

1.5¢

1.8¢/1.9¢

a

Ethanol

4.8¢

6.2¢

3.7¢

4.3¢/4.6¢

a

Liquefied Natural Gas

7.1¢

6.9¢

4.9¢

6.1¢/6.6¢

a

LPG

10.6¢

9.5¢

8.1¢

9.5¢/10.2¢

a

Methanol

3.7¢

4.8¢

2.9¢

3.3¢/3.6¢

a Effective July 1, 2013, pursuant to Kauai County Resolution No. 2013-47, Draft 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2