Instructions For Form Ta-1 - Periodic Transient Accommodations Tax Return

ADVERTISEMENT

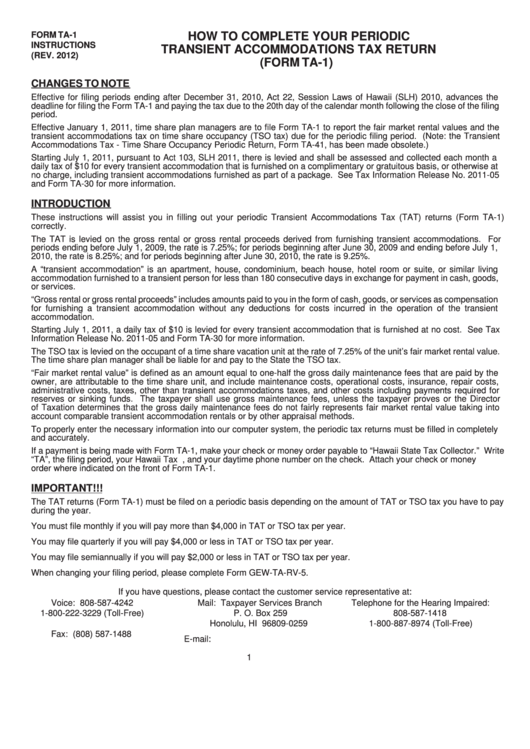

FORM TA-1

HOW TO COMPLETE YOUR PERIODIC

INSTRUCTIONS

TRANSIENT ACCOMMODATIONS TAX RETURN

(REV. 2012)

(FORM TA-1)

CHANGES TO NOTE

Effective for filing periods ending after December 31, 2010, Act 22, Session Laws of Hawaii (SLH) 2010, advances the

deadline for filing the Form TA-1 and paying the tax due to the 20th day of the calendar month following the close of the filing

period.

Effective January 1, 2011, time share plan managers are to file Form TA-1 to report the fair market rental values and the

transient accommodations tax on time share occupancy (TSO tax) due for the periodic filing period. (Note: the Transient

Accommodations Tax - Time Share Occupancy Periodic Return, Form TA-41, has been made obsolete.)

Starting July 1, 2011, pursuant to Act 103, SLH 2011, there is levied and shall be assessed and collected each month a

daily tax of $10 for every transient accommodation that is furnished on a complimentary or gratuitous basis, or otherwise at

no charge, including transient accommodations furnished as part of a package. See Tax Information Release No. 2011-05

and Form TA-30 for more information.

INTRODUCTION

These instructions will assist you in filling out your periodic Transient Accommodations Tax (TAT) returns (Form TA-1)

correctly.

The TAT is levied on the gross rental or gross rental proceeds derived from furnishing transient accommodations. For

periods ending before July 1, 2009, the rate is 7.25%; for periods beginning after June 30, 2009 and ending before July 1,

2010, the rate is 8.25%; and for periods beginning after June 30, 2010, the rate is 9.25%.

A “transient accommodation” is an apartment, house, condominium, beach house, hotel room or suite, or similar living

accommodation furnished to a transient person for less than 180 consecutive days in exchange for payment in cash, goods,

or services.

“Gross rental or gross rental proceeds” includes amounts paid to you in the form of cash, goods, or services as compensation

for furnishing a transient accommodation without any deductions for costs incurred in the operation of the transient

accommodation.

Starting July 1, 2011, a daily tax of $10 is levied for every transient accommodation that is furnished at no cost. See Tax

Information Release No. 2011-05 and Form TA-30 for more information.

The TSO tax is levied on the occupant of a time share vacation unit at the rate of 7.25% of the unit’s fair market rental value.

The time share plan manager shall be liable for and pay to the State the TSO tax.

“Fair market rental value” is defined as an amount equal to one-half the gross daily maintenance fees that are paid by the

owner, are attributable to the time share unit, and include maintenance costs, operational costs, insurance, repair costs,

administrative costs, taxes, other than transient accommodations taxes, and other costs including payments required for

reserves or sinking funds. The taxpayer shall use gross maintenance fees, unless the taxpayer proves or the Director

of Taxation determines that the gross daily maintenance fees do not fairly represents fair market rental value taking into

account comparable transient accommodation rentals or by other appraisal methods.

To properly enter the necessary information into our computer system, the periodic tax returns must be filled in completely

and accurately.

If a payment is being made with Form TA-1, make your check or money order payable to “Hawaii State Tax Collector.” Write

“TA”, the filing period, your Hawaii Tax I.D. No., and your daytime phone number on the check. Attach your check or money

order where indicated on the front of Form TA-1.

IMPORTANT!!!

The TAT returns (Form TA-1) must be filed on a periodic basis depending on the amount of TAT or TSO tax you have to pay

during the year.

You must file monthly if you will pay more than $4,000 in TAT or TSO tax per year.

You may file quarterly if you will pay $4,000 or less in TAT or TSO tax per year.

You may file semiannually if you will pay $2,000 or less in TAT or TSO tax per year.

When changing your filing period, please complete Form GEW-TA-RV-5.

If you have questions, please contact the customer service representative at:

Voice: 808-587-4242

Mail: Taxpayer Services Branch

Telephone for the Hearing Impaired:

1-800-222-3229 (Toll-Free)

P. O. Box 259

808-587-1418

Honolulu, HI 96809-0259

1-800-887-8974 (Toll-Free)

Fax: (808) 587-1488

E-mail: Taxpayer.Services@hawaii.gov

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6