RESET

PRINT

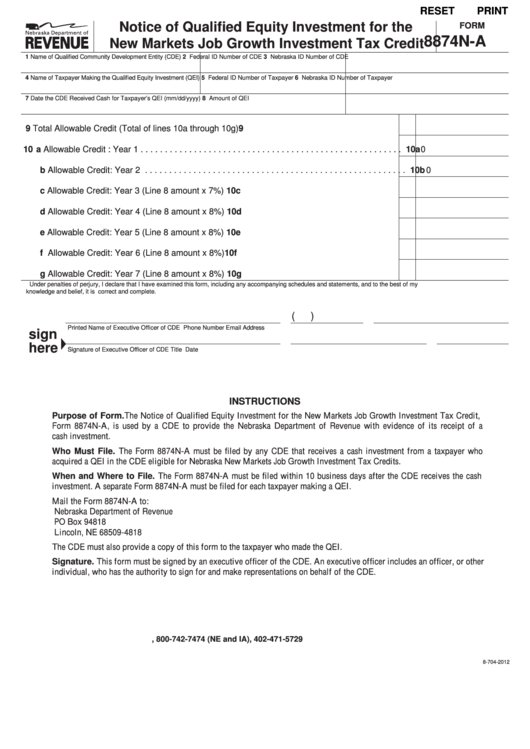

Notice of Qualified Equity Investment for the

FORM

8874N-A

New Markets Job Growth Investment Tax Credit

1 Name of Qualified Community Development Entity (CDE)

2 Federal ID Number of CDE

3 Nebraska ID Number of CDE

4 Name of Taxpayer Making the Qualified Equity Investment (QEI) 5 Federal ID Number of Taxpayer

6 Nebraska ID Number of Taxpayer

7 Date the CDE Received Cash for Taxpayer’s QEI (mm/dd/yyyy)

8 Amount of QEI

9 Total Allowable Credit (Total of lines 10a through 10g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 a Allowable Credit : Year 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10a

0

b Allowable Credit: Year 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b

0

c Allowable Credit: Year 3 (Line 8 amount x 7%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10c

d Allowable Credit: Year 4 (Line 8 amount x 8%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10d

e Allowable Credit: Year 5 (Line 8 amount x 8%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10e

f Allowable Credit: Year 6 (Line 8 amount x 8%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10f

g Allowable Credit: Year 7 (Line 8 amount x 8%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10g

Under penalties of perjury, I declare that I have examined this form, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is correct and complete .

(

)

Printed Name of Executive Officer of CDE

Phone Number

Email Address

sign

here

Signature of Executive Officer of CDE

Title

Date

INSTRUCTIONS

Purpose of Form. The Notice of Qualified Equity Investment for the New Markets Job Growth Investment Tax Credit,

Form 8874N-A, is used by a CDE to provide the Nebraska Department of Revenue with evidence of its receipt of a

cash investment.

Who Must File. The Form 8874N-A must be filed by any CDE that receives a cash investment from a taxpayer who

acquired a QEI in the CDE eligible for Nebraska New Markets Job Growth Investment Tax Credits.

When and Where to File. The Form 8874N-A must be filed within 10 business days after the CDE receives the cash

investment. A separate Form 8874N-A must be filed for each taxpayer making a QEI.

Mail the Form 8874N-A to:

Nebraska Department of Revenue

PO Box 94818

Lincoln, NE 68509-4818

The CDE must also provide a copy of this form to the taxpayer who made the QEI.

Signature. This form must be signed by an executive officer of the CDE. An executive officer includes an officer, or other

individual, who has the authority to sign for and make representations on behalf of the CDE.

, 800-742-7474 (NE and IA), 402-471-5729

8-704-2012

1

1