Instructions For Schedule L Of H-1040(R) - City Of Hamtramck Income Tax

ADVERTISEMENT

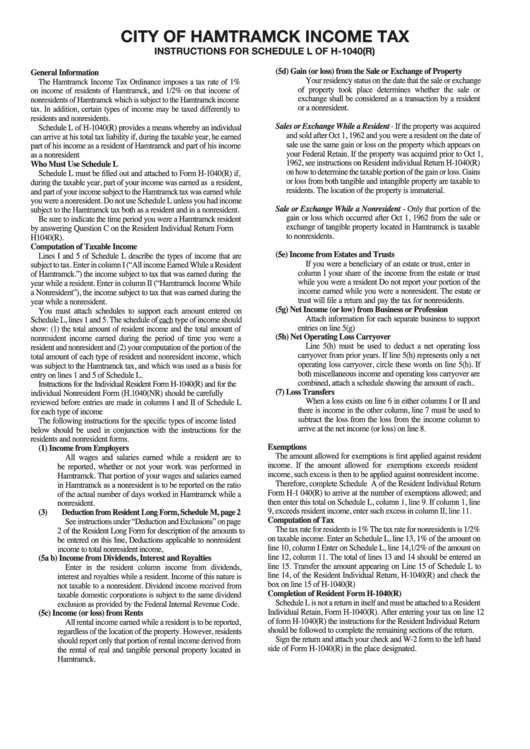

CITY OF HAMTRAMCK INCOME TAX

INSTRUCTIONS FOR SCHEDULE L OF H-1040(R)

(5d)

Gain (or loss) from the Sale or Exchange of Property

General Information

Your residency status on the date that the sale or exchange

The Hamtramck Income Tax Ordinance imposes a tax rate of 1%

of property took place determines whether the sale or

on income of residents of Hamtramck, and 1/2% on that income of

exchange shall be considered as a transaction by a resident

nonresidents of Hamtramck which is subject to the Hamtramck income

or a nonresident.

tax. In addition, certain types of income may be taxed differently to

residents and nonresidents.

Sales or Exchange While a Resident - If the property was acquired

Schedule L of H-1040(R) provides a means whereby an individual

and sold after Oct 1, 1962 and you were a resident on the date of

can arrive at his total tax liability if, during the taxable year, he earned

sale use the same gain or loss on the property which appears on

part of his income as a resident of Hamtramck and part of his income

your Federal Retain. If the property was acquired prior to Oct 1,

as a nonresident

1962, see instructions on Resident individual Return H-1040(R)

Who Must Use Schedule L

on how to determine the taxable portion of the gain or loss. Gains

Schedule L must be filled out and attached to Form H-1040(R) if,

or loss from both tangible and intangible property are taxable to

during the taxable year, part of your income was earned as a resident,

residents. The location of the property is immaterial.

and part of your income subject to the Hamtramck tax was earned while

you were a nonresident. Do not use Schedule L unless you had income

Sale or Exchange While a Nonresident - Only that portion of the

subject to the Hamtramck tax both as a resident and in a nonresident.

gain or loss which occurred after Oct 1, 1962 from the sale or

Be sure to indicate the time period you were a Hamtramck resident

exchange of tangible property located in Hamtramck is taxable

by answering Question C on the Resident Individual Return Form

to nonresidents.

H1040(R).

Computation of Taxable Income

(5e)

Income from Estates and Trusts

Lines I and 5 of Schedule L describe the types of income that are

If you were a beneficiary of an estate or trust, enter in

subject to tax. Enter in column I (“All income Earned While a Resident

column I your share of the income from the estate or trust

of Hamtramck.”) the income subject to tax that was earned during the

while you were a resident Do not report your portion of the

year while a resident. Enter in column II (“Hamtramck Income While

income earned while you were a nonresident. The estate or

a Nonresident”), the income subject to tax that was earned during the

trust will file a return and pay the tax for nonresidents.

year while a nonresident.

(5g)

Net Income (or low) from Business or Profession

You must attach schedules to support each amount entered on

Attach information for each separate business to support

Schedule L, lines 1 and 5. The schedule of each type of income should

entries on line 5(g)

show: (1) the total amount of resident income and the total amount of

(5h)

Net Operating Loss Carryover

nonresident income earned during the period of time you were a

Line 5(h) must be used to deduct a net operating loss

resident and nonresident and (2) your computation of the portion of the

carryover from prior years. If line 5(h) represents only a net

total amount of each type of resident and nonresident income, which

operating loss carryover, circle these words on line 5(h). If

was subject to the Hamtramck tax, and which was used as a basis for

both miscellaneous income and operating loss carryover are

entry on lines 1 and 5 of Schedule L.

combined, attach a schedule showing the amount of each..

Instructions for the Individual Resident Form H-1040(R) and for the

(7)

Loss Transfers

individual Nonresident Form (H.1040(NR) should be carefully

When a loss exists on line 6 in either columns I or II and

reviewed before entries are made in columns I and II of Schedule L

there is income in the other column, line 7 must be used to

for each type of income

subtract the loss from the loss from the income column to

The following instructions for the specific types of income listed

arrive at the net income (or loss) on line 8.

below should be used in conjunction with the instructions for the

residents and nonresident forms.

Exemptions

(1)

Income from Employers

The amount allowed for exemptions is first applied against resident

All wages and salaries earned while a resident are to

income. If the amount allowed for exemptions exceeds resident

be reported, whether or not your work was performed in

income, such excess is then to be applied against nonresident income.

Hamtramck. That portion of your wages and salaries earned

Therefore, complete Schedule A of the Resident Individual Return

in Hamtramck as a nonresident is to be reported on the ratio

Form H-1 040(R) to arrive at the number of exemptions allowed; and

of the actual number of days worked in Hamtramck while a

then enter this total on Schedule L, column 1, line 9. If column 1, line

nonresident.

9, exceeds resident income, enter such excess in column II, line 11.

(3)

Deduction from Resident Long Form, Schedule M, page 2

Computation of Tax

See instructions under “Deduction and Exclusions” on page

The tax rate for residents is 1% The tax rate for nonresidents is 1/2%

2 of the Resident Long Form for description of the amounts to

on taxable income. Enter an Schedule L, line 13, 1% of the amount on

be entered on this line, Deductions applicable to nonresident

line 10, column I Enter on Schedule L, line 14,1/2% of the amount on

income to total nonresident income,

line 12, column 11. The total of lines 13 and 14 should be entered an

(5a b) Income from Dividends, Interest and Royalties

line 15. Transfer the amount appearing on Line 15 of Schedule L to

Enter in the resident column income from dividends,

line 14, of the Resident Individual Return, H-1040(R) and check the

interest and royalties while a resident. Income of this nature is

box on line 15 of H-1040(R)

not taxable to a nonresident. Dividend income received from

Completion of Resident Form H-1040(R)

taxable domestic corporations is subject to the same dividend

Schedule L is not a return in itself and must be attached to a Resident

exclusion as provided by the Federal Internal Revenue Code.

Individual Retain, Form H-1040(R). After entering your tax on line 12

(5c)

Income (or loss) from Rents

of form H-1040(R) the instructions for the Resident Individual Return

All rental income earned while a resident is to be reported,

should be followed to complete the remaining sections of the return.

regardless of the location of the property. However, residents

Sign the return and attach your check and W-2 form to the left hand

should report only that portion of rental income derived from

side of Form H-1040(R) in the place designated.

the rental of real and tangible personal property located in

Hamtramck.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1