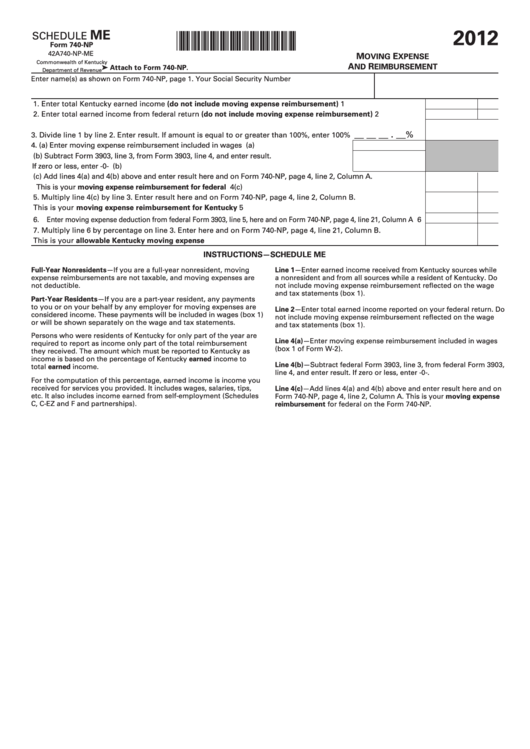

2012

ME

SCHEDULE

*1200030015*

Form 740-NP

42A740-NP-ME

M

E

OVING

XPENSE

Commonwealth of Kentucky

A

R

ND

EIMBURSEMENT

➤ Attach to Form 740-NP.

Department of Revenue

Enter name(s) as shown on Form 740-NP, page 1.

Your Social Security Number

1. Enter total Kentucky earned income (do not include moving expense reimbursement) ................................. 1

2. Enter total earned income from federal return (do not include moving expense reimbursement) ................ 2

__ __ __ . __

%

3. Divide line 1 by line 2. Enter result. If amount is equal to or greater than 100%, enter 100% .......................... 3

4. (a) Enter moving expense reimbursement included in wages ......................................... 4(a)

(b) Subtract Form 3903, line 3, from Form 3903, line 4, and enter result.

If zero or less, enter -0- ..................................................................................................... 4(b)

(c) Add lines 4(a) and 4(b) above and enter result here and on Form 740-NP, page 4, line 2, Column A.

This is your moving expense reimbursement for federal .............................................................................. 4(c)

5. Multiply line 4(c) by line 3. Enter result here and on Form 740-NP, page 4, line 2, Column B.

This is your moving expense reimbursement for Kentucky ............................................................................... 5

6. Enter moving expense deduction from federal Form 3903, line 5, here and on Form 740-NP, page 4, line 21, Column A 6

7. Multiply line 6 by percentage on line 3. Enter here and on Form 740-NP, page 4, line 21, Column B.

This is your allowable Kentucky moving expense .............................................................................................. 7

INSTRUCTIONS—SCHEDULE ME

Full-Year Nonresidents—If you are a full-year nonresident, moving

Line 1—Enter earned income received from Kentucky sources while

expense reimbursements are not taxable, and moving expenses are

a nonresident and from all sources while a resident of Kentucky. Do

not deductible.

not include moving expense reimbursement reflected on the wage

and tax statements (box 1).

Part-Year Residents—If you are a part-year resident, any payments

to you or on your behalf by any employer for moving expenses are

Line 2—Enter total earned income reported on your federal return. Do

considered income. These payments will be included in wages (box 1)

not include moving expense reimbursement reflected on the wage

or will be shown separately on the wage and tax statements.

and tax statements (box 1).

Persons who were residents of Kentucky for only part of the year are

Line 4(a)—Enter moving expense reimbursement included in wages

required to report as income only part of the total reimbursement

(box 1 of Form W-2).

they received. The amount which must be reported to Kentucky as

income is based on the percentage of Kentucky earned income to

Line 4(b)—Subtract federal Form 3903, line 3, from federal Form 3903,

total earned income.

line 4, and enter result. If zero or less, enter -0-.

For the computation of this percentage, earned income is income you

received for services you provided. It includes wages, salaries, tips,

Line 4(c)—Add lines 4(a) and 4(b) above and enter result here and on

etc. It also includes income earned from self-employment (Schedules

Form 740-NP, page 4, line 2, Column A. This is your moving expense

C, C-EZ and F and partnerships).

reimbursement for federal on the Form 740-NP.

1

1