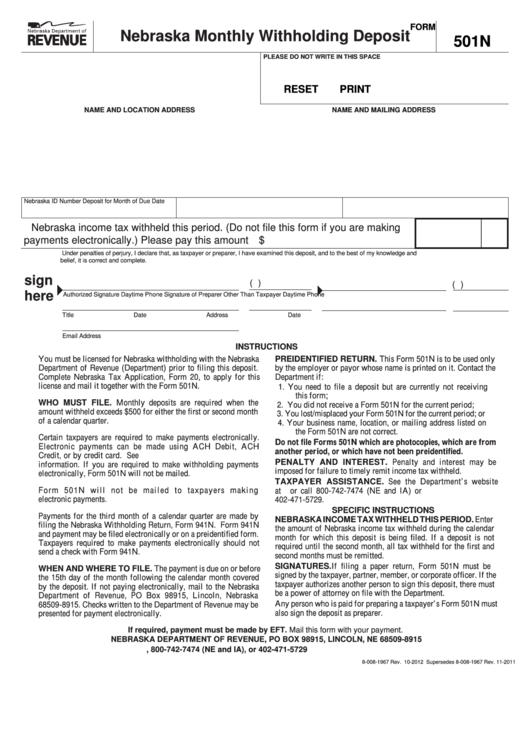

FORM

Nebraska Monthly Withholding Deposit

501N

PLEASE DO NOT WRITE IN THIS SPACE

RESET

PRINT

NAME AND MAILING ADDRESS

NAME AND LOCATION ADDRESS

Nebraska ID Number

Deposit for Month of

Due Date

Nebraska income tax withheld this period. (Do not file this form if you are making

payments electronically.) Please pay this amount .....................................................

$

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this deposit, and to the best of my knowledge and

belief, it is correct and complete.

sign

(

)

(

)

here

Authorized Signature

Daytime Phone

Signature of Preparer Other Than Taxpayer

Daytime Phone

Title

Date

Address

Date

Email Address

INSTRUCTIONS

PREIDENTIFIED RETURN. This Form 501N is to be used only

You must be licensed for Nebraska withholding with the Nebraska

Department of Revenue (Department) prior to filing this deposit.

by the employer or payor whose name is printed on it. Contact the

Complete Nebraska Tax Application, Form 20, to apply for this

Department if:

license and mail it together with the Form 501N.

1. You need to file a deposit but are currently not receiving

this form;

WHO MUST FILE. Monthly deposits are required when the

2. You did not receive a Form 501N for the current period;

amount withheld exceeds $500 for either the first or second month

3. You lost/misplaced your Form 501N for the current period; or

of a calendar quarter.

4. Your business name, location, or mailing address listed on

the Form 501N are not correct.

Certain taxpayers are required to make payments electronically.

Do not file Forms 501N which are photocopies, which are from

Electronic payments can be made using ACH Debit, ACH

another period, or which have not been preidentified.

Credit, or by credit card. See for additional

PENALTY AND INTEREST. Penalty and interest may be

information. If you are required to make withholding payments

imposed for failure to timely remit income tax withheld.

electronically, Form 501N will not be mailed.

TAXPAYER ASSISTANCE. See the Department’s website

Form 501N will not be mailed to taxpayers making

at or call 800-742-7474 (NE and IA) or

electronic payments.

402-471-5729.

SPECIFIC INSTRUCTIONS

Payments for the third month of a calendar quarter are made by

NEBRASKA INCOME TAX WITHHELD THIS PERIOD. Enter

filing the Nebraska Withholding Return, Form 941N. Form 941N

the amount of Nebraska income tax withheld during the calendar

and payment may be filed electronically or on a preidentified form.

month for which this deposit is being filed. If a deposit is not

Taxpayers required to make payments electronically should not

required until the second month, all tax withheld for the first and

send a check with Form 941N.

second months must be remitted.

SIGNATURES. If filing a paper return, Form 501N must be

WHEN AND WHERE TO FILE. The payment is due on or before

signed by the taxpayer, partner, member, or corporate officer. If the

the 15th day of the month following the calendar month covered

taxpayer authorizes another person to sign this deposit, there must

by the deposit. If not paying electronically, mail to the Nebraska

be a power of attorney on file with the Department.

Department of Revenue, PO Box 98915, Lincoln, Nebraska

Any person who is paid for preparing a taxpayer’s Form 501N must

68509-8915. Checks written to the Department of Revenue may be

also sign the deposit as preparer.

presented for payment electronically.

If required, payment must be made by EFT. Mail this form with your payment.

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98915, LINCOLN, NE 68509-8915

, 800-742-7474 (NE and IA), or 402-471-5729

8-008-1967 Rev. 10-2012 Supersedes 8-008-1967 Rev. 11-2011

1

1