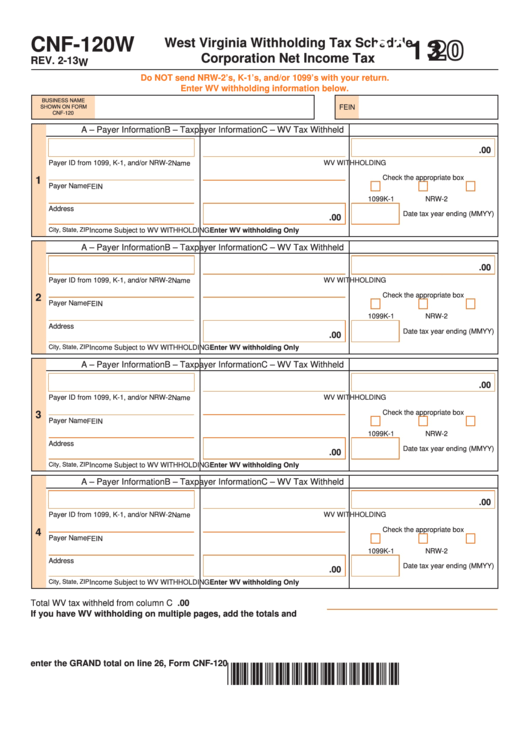

Form Cnf-120w - West Virginia Withholding Tax Schedule - Corporation Net Income Tax - 2013

ADVERTISEMENT

2013

CNF-120W

West Virginia Withholding Tax Schedule

Corporation Net Income Tax

REV. 2-13

W

Do NOT send NRW-2’s, K-1’s, and/or 1099’s with your return.

Enter WV withholding information below.

BUSINESS NAME

SHOWN ON FORM

FEIN

CNF-120

A – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer ID from 1099, K-1, and/or NRW-2

WV WITHHOLDING

Name

1

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

Address

Date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLDING

Enter WV withholding Only

A – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer ID from 1099, K-1, and/or NRW-2

WV WITHHOLDING

Name

2

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

Address

Date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLDING

Enter WV withholding Only

A – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer ID from 1099, K-1, and/or NRW-2

WV WITHHOLDING

Name

3

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

Address

Date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLDING

Enter WV withholding Only

A – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer ID from 1099, K-1, and/or NRW-2

WV WITHHOLDING

Name

4

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

Address

Date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLDING

Enter WV withholding Only

Total WV tax withheld from column C above....................................................

.00

If you have WV withholding on multiple pages, add the totals and

enter the GRAND total on line 26, Form CNF-120

*B30201310W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1