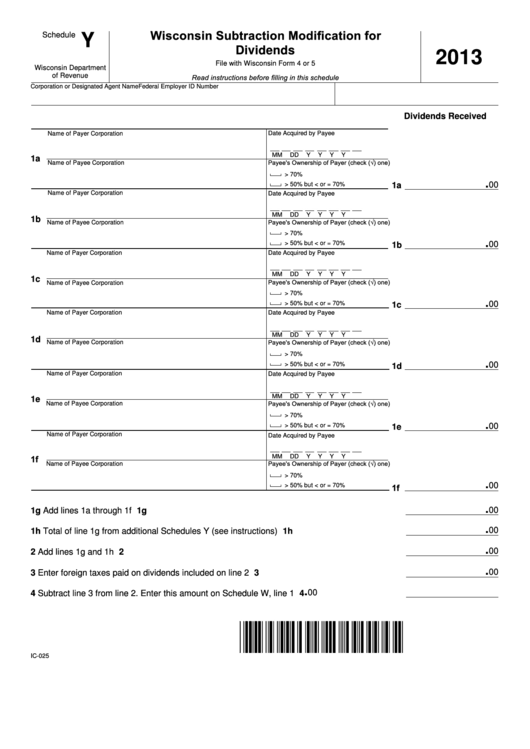

Wisconsin Subtraction Modification for

Schedule

Y

Dividends

2013

File with Wisconsin Form 4 or 5

Wisconsin Department

of Revenue

Read instructions before filling in this schedule

Corporation or Designated Agent Name

Federal Employer ID Number

Dividends Received

Date Acquired by Payee

Name of Payer Corporation

M M

D

D

Y

Y

Y

Y

1a

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

00

> 50% but < or = 70%

1a

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1b

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1b

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1c

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1c

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1d

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

00

> 50% but < or = 70%

1d

Name of Payer Corporation

Date Acquired by Payee

M M

D

D

Y

Y

Y

Y

1e

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

> 50% but < or = 70%

00

1e

Name of Payer Corporation

Date Acquired by Payee

1f

M M

D

D

Y

Y

Y

Y

Payee's Ownership of Payer (check (√) one)

Name of Payee Corporation

> 70%

.

1f

00

> 50% but < or = 70%

.

00

1g Add lines 1a through 1f . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1g

.

00

1h Total of line 1g from additional Schedules Y (see instructions) . . . . . . . . . . . . . . . . . . . . . . 1h

.

00

2

Add lines 1g and 1h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

00

3

Enter foreign taxes paid on dividends included on line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

00

4

Subtract line 3 from line 2 . Enter this amount on Schedule W, line 1 . . . . . . . . . . . . . . . . . 4

IC-025

1

1