Form Nc K-1 - Partner'S Share Of North Carolina Income, Adjustments, And Credits - 2011

ADVERTISEMENT

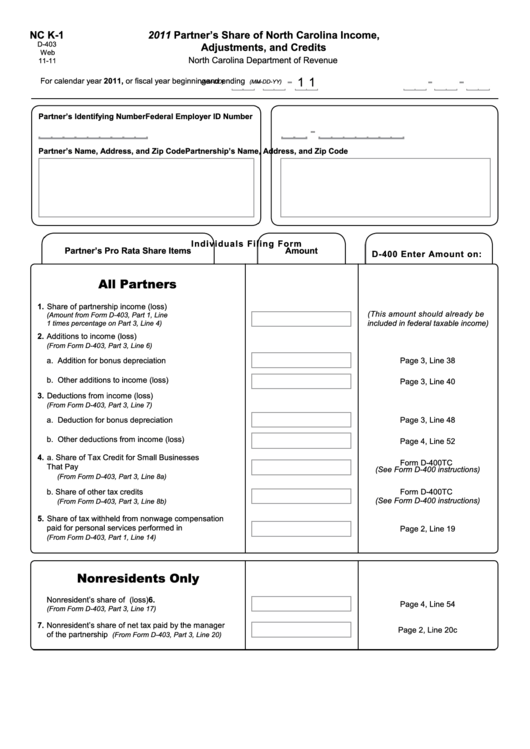

NC K-1

2011 Partner’s Share of North Carolina Income,

D-403

Adjustments, and Credits

Web

North Carolina Department of Revenue

11-11

1 1

For calendar year 2011, or fiscal year beginning

and ending

(MM-DD-YY)

(MM-DD)

Partner’s Identifying Number

Federal Employer ID Number

Partner’s Name, Address, and Zip Code

Partnership’s Name, Address, and Zip Code

Individuals Filing Form

Partner’s Pro Rata Share Items

Amount

D-400 Enter Amount on:

All Partners

1. Share of partnership income (loss)

(This amount should already be

(Amount from Form D-403, Part 1, Line

included in federal taxable income)

1 times percentage on Part 3, Line 4)

2.

Additions to income (loss)

(From Form D-403, Part 3, Line 6)

a. Addition for bonus depreciation

Page 3, Line 38

b. Other additions to income (loss)

Page 3, Line 40

3. Deductions from income (loss)

(From Form D-403, Part 3, Line 7)

a. Deduction for bonus depreciation

Page 3, Line 48

b. Other deductions from income (loss)

Page 4, Line 52

4. a. Share of Tax Credit for Small Businesses

Form D-400TC

That Pay N.C. Unemployment Insurance

(See Form D-400 instructions)

(From Form D-403, Part 3, Line 8a)

b. Share of other tax credits

Form D-400TC

(See Form D-400 instructions)

(From Form D-403, Part 3, Line 8b)

5. Share of tax withheld from nonwage compensation

paid for personal services performed in N.C.

Page 2, Line 19

(From Form D-403, Part 1, Line 14)

Nonresidents Only

6.

Nonresident’s share of N.C. taxable income (loss)

Page 4, Line 54

(From Form D-403, Part 3, Line 17)

7.

Nonresident’s share of net tax paid by the manager

Page 2, Line 20c

of the partnership

(From Form D-403, Part 3, Line 20)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1