Lender'S Credit

Download a blank fillable Lender'S Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Lender'S Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Clear Form

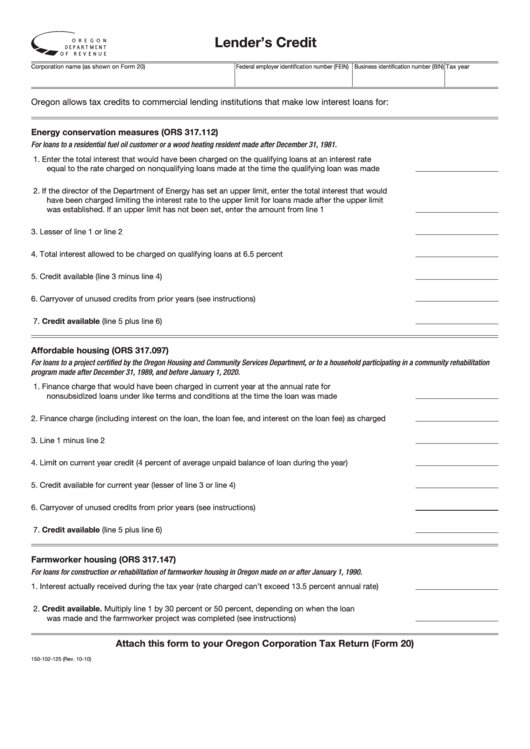

Lender’s Credit

Corporation name (as shown on Form 20)

Federal employer identification number (FEIN)

Business identification number (BIN)

Tax year

Oregon allows tax credits to commercial lending institutions that make low interest loans for:

Energy conservation measures (ORS 317.112)

For loans to a residential fuel oil customer or a wood heating resident made after December 31, 1981.

1. Enter the total interest that would have been charged on the qualifying loans at an interest rate

equal to the rate charged on nonqualifying loans made at the time the qualifying loan was made ............1.

2. If the director of the Department of Energy has set an upper limit, enter the total interest that would

have been charged limiting the interest rate to the upper limit for loans made after the upper limit

was established. If an upper limit has not been set, enter the amount from line 1 .....................................2.

3. Lesser of line 1 or line 2 ...............................................................................................................................3.

4. Total interest allowed to be charged on qualifying loans at 6.5 percent ......................................................4.

5. Credit available (line 3 minus line 4) .............................................................................................................5.

6. Carryover of unused credits from prior years (see instructions) ..................................................................6.

7. Credit available (line 5 plus line 6) ..............................................................................................................7.

Affordable housing (ORS 317.097)

For loans to a project certified by the Oregon Housing and Community Services Department, or to a household participating in a community rehabilitation

program made after December 31, 1989, and before January 1, 2020.

1. Finance charge that would have been charged in current year at the annual rate for

nonsubsidized loans under like terms and conditions at the time the loan was made ...............................1.

2. Finance charge (including interest on the loan, the loan fee, and interest on the loan fee) as charged ......2.

3. Line 1 minus line 2 .......................................................................................................................................3.

4. Limit on current year credit (4 percent of average unpaid balance of loan during the year) ........................4.

5. Credit available for current year (lesser of line 3 or line 4) ...........................................................................5.

6. Carryover of unused credits from prior years (see instructions) ..................................................................6.

7. Credit available (line 5 plus line 6) ..............................................................................................................7.

Farmworker housing (ORS 317.147)

For loans for construction or rehabilitation of farmworker housing in Oregon made on or after January 1, 1990.

1. Interest actually received during the tax year (rate charged can’t exceed 13.5 percent annual rate) ..........1.

2. Credit available. Multiply line 1 by 30 percent or 50 percent, depending on when the loan

was made and the farmworker project was completed (see instructions) ...................................................2.

Attach this form to your Oregon Corporation Tax Return (Form 20)

150-102-125 (Rev. 10-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3