Reset Form

Print Form

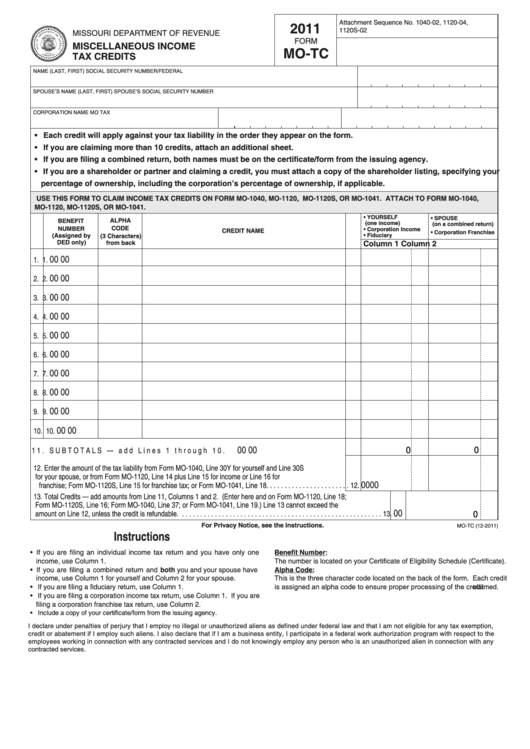

Attachment Sequence No. 1040-02, 1120-04,

2011

1120S-02

MISSOURI DEPARTMENT OF REVENUE

FORM

MISCELLANEOUS INCOME

MO-TC

TAX CREDITS

NAME (LAST, FIRST)

SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER

SPOUSE’S NAME (LAST, FIRST)

SPOUSE’S SOCIAL SECURITY NUMBER

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

• E ach credit will apply against your tax liability in the order they appear on the form.

• I f you are claiming more than 10 credits, attach an additional sheet.

• I f you are filing a combined return, both names must be on the certificate/form from the issuing agency.

• I f you are a shareholder or partner and claiming a credit, you must attach a copy of the shareholder listing, specifying your

percentage of ownership, including the corporation’s percentage of ownership, if applicable.

USE THIS FORM TO CLAIM INCOME TAX CREDITS ON FORM MO-1040, MO-1120, MO-1120S, OR MO-1041. ATTACH TO FORM MO-1040,

MO-1120, MO-1120S, OR MO-1041.

• YOURSELF

• SPOUSE

BENEFIT

ALPHA

(one income)

(on a combined return)

NUMBER

CODE

• Corporation Income

CREDIT NAME

• Corporation Franchise

(Assigned by

• Fiduciary

(3 Characters)

DED only)

from back

Column 1

Column 2

00

00

1.

1.

00

00

2.

2.

00

00

3.

3.

00

00

4.

4.

00

00

5.

5.

00

00

6.

6.

00

00

7.

7.

00

00

8.

8.

00

00

9.

9.

00

00

10.

10.

0

0

00

00

11. SUBTOTALS — add Lines 1 through 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Enter the amount of the tax liability from Form MO‑1040, Line 30Y for yourself and Line 30S

for your spouse, or from Form MO‑1120, Line 14 plus Line 15 for income or Line 16 for

00

00

franchise; Form MO‑1120S, Line 15 for franchise tax; or Form MO‑1041, Line 18. . . . . . . . . . . . . . . . . . . . . . . 12.

13. Total Credits — add amounts from Line 11, Columns 1 and 2. (Enter here and on Form MO‑1120, Line 18;

Form MO‑1120S, Line 16; Form MO‑1040, Line 37; or Form MO‑1041, Line 19.) Line 13 cannot exceed the

00

0

amount on Line 12, unless the credit is refundable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

For Privacy Notice, see the instructions.

MO-TC (12-2011)

Instructions

• I f you are filing an individual income tax return and you have only one

Benefit Number:

income, use Column 1.

The number is located on your Certificate of Eligibility Schedule (Certificate).

• I f you are filing a combined return and both you and your spouse have

Alpha Code:

income, use Column 1 for yourself and Column 2 for your spouse.

This is the three character code located on the back of the form. Each credit

• I f you are filing a fiduciary return, use Column 1.

is assigned an alpha code to ensure proper processing of the credit claimed.

• I f you are filing a corporation income tax return, use Column 1. If you are

filing a corporation franchise tax return, use Column 2.

• Include a copy of your certificate/form from the issuing agency.

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption,

credit or abatement if I employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization program with respect to the

employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized alien in connection with any

contracted services.

1

1 2

2