Form 41a720ezc (10-12) - Schedule Ezc - Enterprise Zone Tax Credit

ADVERTISEMENT

*1200020225*

Taxable Year Ending

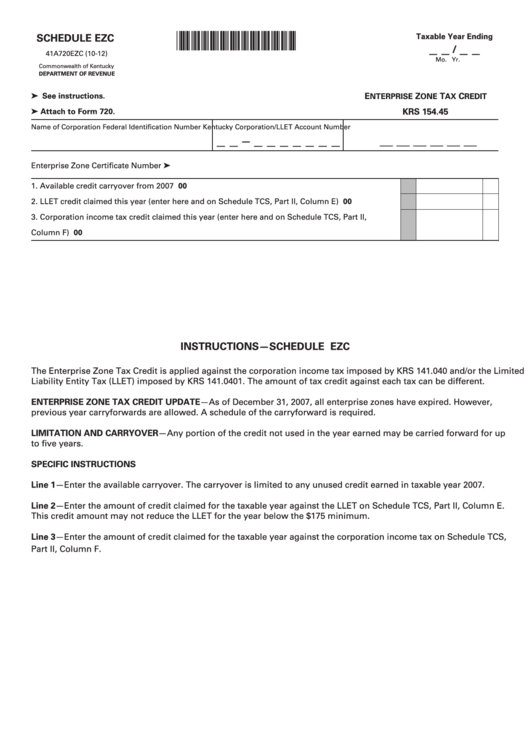

SCHEDULE EZC

_ _

_ _

/

41A720EZC (10-12)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

E

Z

T

C

➤ See instructions.

NTERPRISE

ONE

AX

REDIT

KRS 154.45

➤ Attach to Form 720.

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET Account Number

_ _

_ _ _ _ _ _ _

__ __ __ __ __ __

—

Enterprise Zone Certificate Number ➤

1.

Available credit carryover from 2007 ...................................................................................................

1

00

2.

LLET credit claimed this year (enter here and on Schedule TCS, Part II, Column E) .......................

2

00

3.

Corporation income tax credit claimed this year (enter here and on Schedule TCS, Part II,

Column F) ...............................................................................................................................................

3

00

INSTRUCTIONS—SCHEDULE EZC

The Enterprise Zone Tax Credit is applied against the corporation income tax imposed by KRS 141.040 and/or the Limited

Liability Entity Tax (LLET) imposed by KRS 141.0401. The amount of tax credit against each tax can be different.

ENTERPRISE ZONE TAX CREDIT UPDATE—As of December 31, 2007, all enterprise zones have expired. However,

previous year carryforwards are allowed. A schedule of the carryforward is required.

LIMITATION AND CARRYOVER—Any portion of the credit not used in the year earned may be carried forward for up

to five years.

SPECIFIC INSTRUCTIONS

Line 1—Enter the available carryover. The carryover is limited to any unused credit earned in taxable year 2007.

Line 2—Enter the amount of credit claimed for the taxable year against the LLET on Schedule TCS, Part II, Column E.

This credit amount may not reduce the LLET for the year below the $175 minimum.

Line 3—Enter the amount of credit claimed for the taxable year against the corporation income tax on Schedule TCS,

Part II, Column F.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1