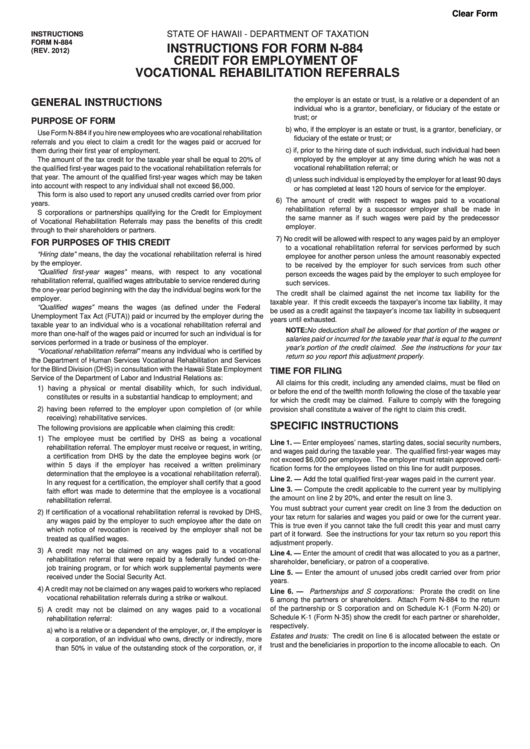

Instructions For Form N-884 Credit For Employment Of Vocational Rehabilitation Referrals

ADVERTISEMENT

Clear Form

INSTRUCTIONS

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM N-884

INSTRUCTIONS FOR FORM N-884

(REV. 2012)

CREDIT FOR EMPLOYMENT OF

VOCATIONAL REHABILITATION REFERRALS

the employer is an estate or trust, is a relative or a dependent of an

GENERAL INSTRUCTIONS

individual who is a grantor, beneficiary, or fiduciary of the estate or

trust; or

PURPOSE OF FORM

b) who, if the employer is an estate or trust, is a grantor, beneficiary, or

Use Form N-884 if you hire new employees who are vocational rehabilitation

fiduciary of the estate or trust; or

referrals and you elect to claim a credit for the wages paid or accrued for

c) if, prior to the hiring date of such individual, such individual had been

them during their first year of employment.

employed by the employer at any time during which he was not a

The amount of the tax credit for the taxable year shall be equal to 20% of

vocational rehabilitation referral; or

the qualified first-year wages paid to the vocational rehabilitation referrals for

that year. The amount of the qualified first-year wages which may be taken

d) unless such individual is employed by the employer for at least 90 days

into account with respect to any individual shall not exceed $6,000.

or has completed at least 120 hours of service for the employer.

This form is also used to report any unused credits carried over from prior

6) The amount of credit with respect to wages paid to a vocational

years.

rehabilitation referral by a successor employer shall be made in

S corporations or partnerships qualifying for the Credit for Employment

the same manner as if such wages were paid by the predecessor

of Vocational Rehabilitation Referrals may pass the benefits of this credit

employer.

through to their shareholders or partners.

7) No credit will be allowed with respect to any wages paid by an employer

FOR PURPOSES OF THIS CREDIT

to a vocational rehabilitation referral for services performed by such

“Hiring date” means, the day the vocational rehabilitation referral is hired

employee for another person unless the amount reasonably expected

by the employer.

to be received by the employer for such services from such other

“Qualified first-year wages” means, with respect to any vocational

person exceeds the wages paid by the employer to such employee for

rehabilitation referral, qualified wages attributable to service rendered during

such services.

the one-year period beginning with the day the individual begins work for the

The credit shall be claimed against the net income tax liability for the

employer.

taxable year. If this credit exceeds the taxpayer’s income tax liability, it may

“Qualified wages” means the wages (as defined under the Federal

be used as a credit against the taxpayer’s income tax liability in subsequent

Unemployment Tax Act (FUTA)) paid or incurred by the employer during the

years until exhausted.

taxable year to an individual who is a vocational rehabilitation referral and

NOTE: No deduction shall be allowed for that portion of the wages or

more than one-half of the wages paid or incurred for such an individual is for

salaries paid or incurred for the taxable year that is equal to the current

services performed in a trade or business of the employer.

year’s portion of the credit claimed. See the instructions for your tax

“Vocational rehabilitation referral” means any individual who is certified by

return so you report this adjustment properly.

the Department of Human Services Vocational Rehabilitation and Services

for the Blind Division (DHS) in consultation with the Hawaii State Employment

TIME FOR FILING

Service of the Department of Labor and Industrial Relations as:

All claims for this credit, including any amended claims, must be filed on

1) having a physical or mental disability which, for such individual,

or before the end of the twelfth month following the close of the taxable year

constitutes or results in a substantial handicap to employment; and

for which the credit may be claimed. Failure to comply with the foregoing

2) having been referred to the employer upon completion of (or while

provision shall constitute a waiver of the right to claim this credit.

receiving) rehabilitative services.

SPECIFIC INSTRUCTIONS

The following provisions are applicable when claiming this credit:

1) The employee must be certified by DHS as being a vocational

Line 1. — Enter employees’ names, starting dates, social security numbers,

rehabilitation referral. The employer must receive or request, in writing,

and wages paid during the taxable year. The qualified first-year wages may

a certification from DHS by the date the employee begins work (or

not exceed $6,000 per employee. The employer must retain approved certi-

within 5 days if the employer has received a written preliminary

fication forms for the employees listed on this line for audit purposes.

determination that the employee is a vocational rehabilitation referral).

Line 2. — Add the total qualified first-year wages paid in the current year.

In any request for a certification, the employer shall certify that a good

Line 3. — Compute the credit applicable to the current year by multiplying

faith effort was made to determine that the employee is a vocational

the amount on line 2 by 20%, and enter the result on line 3.

rehabilitation referral.

You must subtract your current year credit on line 3 from the deduction on

2) If certification of a vocational rehabilitation referral is revoked by DHS,

your tax return for salaries and wages you paid or owe for the current year.

any wages paid by the employer to such employee after the date on

This is true even if you cannot take the full credit this year and must carry

which notice of revocation is received by the employer shall not be

part of it forward. See the instructions for your tax return so you report this

treated as qualified wages.

adjustment properly.

3) A credit may not be claimed on any wages paid to a vocational

Line 4. — Enter the amount of credit that was allocated to you as a partner,

rehabilitation referral that were repaid by a federally funded on-the-

shareholder, beneficiary, or patron of a cooperative.

job training program, or for which work supplemental payments were

Line 5. — Enter the amount of unused jobs credit carried over from prior

received under the Social Security Act.

years.

4) A credit may not be claimed on any wages paid to workers who replaced

Line 6. — Partnerships and S corporations: Prorate the credit on line

vocational rehabilitation referrals during a strike or walkout.

6 among the partners or shareholders. Attach Form N-884 to the return

of the partnership or S corporation and on Schedule K-1 (Form N-20) or

5) A credit may not be claimed on any wages paid to a vocational

Schedule K-1 (Form N-35) show the credit for each partner or shareholder,

rehabilitation referral:

respectively.

a) who is a relative or a dependent of the employer, or, if the employer is

Estates and trusts: The credit on line 6 is allocated between the estate or

a corporation, of an individual who owns, directly or indirectly, more

trust and the beneficiaries in proportion to the income allocable to each. On

than 50% in value of the outstanding stock of the corporation, or, if

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2