Form Pte - New Mexico Information Return For Pass-Through Entities - 2011

ADVERTISEMENT

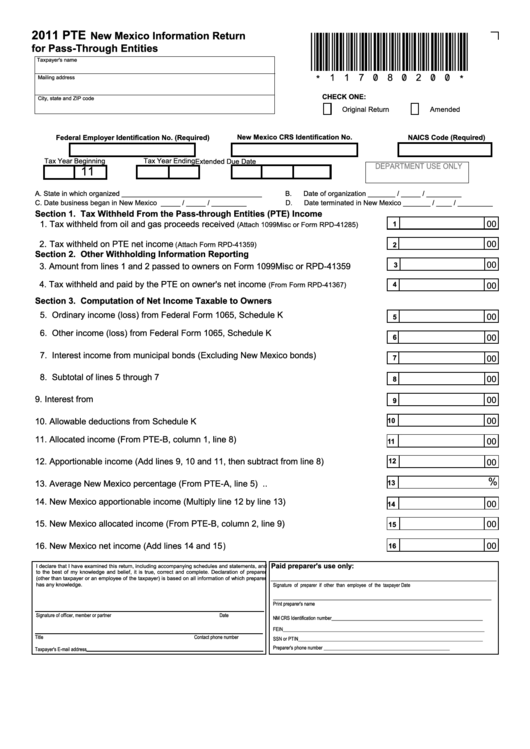

2011 PTE

New Mexico Information Return

*117080200*

for Pass-Through Entities

Taxpayer's name

Mailing address

CHECK ONE:

City, state and ZIP code

Original Return

Amended

New Mexico CRS Identification No.

NAICS Code (Required)

Federal Employer Identification No. (Required)

Tax Year Beginning

Tax Year Ending

Extended Due Date

DEPARTMENT USE ONLY

11

A.

State in which organized ____________________________________

B.

Date of organization _______ / _____ / _________

C.

Date business began in New Mexico _____ / _____ / _________

D.

Date terminated in New Mexico _______ / ____ / _________

Section 1. Tax Withheld From the Pass-through Entities (PTE) Income

1. Tax withheld from oil and gas proceeds received

..........

00

1

(Attach 1099Misc or Form RPD-41285)

.

2

Tax withheld on PTE net income

....................................................

00

(Attach Form RPD-41359)

2

Section 2. Other Withholding Information Reporting

00

3. Amount from lines 1 and 2 passed to owners on Form 1099Misc or RPD-41359 ............

3

4. Tax withheld and paid by the PTE on owner's net income

..............

4

00

(From Form RPD-41367)

Section 3. Computation of Net Income Taxable to Owners

5. Ordinary income (loss) from Federal Form 1065, Schedule K ........................................

00

5

6. Other income (loss) from Federal Form 1065, Schedule K .............................................

00

6

7. Interest income from municipal bonds (Excluding New Mexico bonds) ..........................

00

7

8. Subtotal of lines 5 through 7 ............................................................................................

00

8

9. Interest from U.S. government obligations or federally taxed New Mexico bonds ...........

00

9

00

10. Allowable deductions from Schedule K ............................................................................

10

11. Allocated income (From PTE-B, column 1, line 8) ............................................................

00

11

12. Apportionable income (Add lines 9, 10 and 11, then subtract from line 8) .......................

12

00

%

13. Average New Mexico percentage (From PTE-A, line 5)................................................. ..

13

14. New Mexico apportionable income (Multiply line 12 by line 13) ......................................

00

14

15. New Mexico allocated income (From PTE-B, column 2, line 9) .......................................

00

15

16. New Mexico net income (Add lines 14 and 15) ................................................................

00

16

Paid preparer's use only:

I declare that I have examined this return, including accompanying schedules and statements, and

to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer

(other than taxpayer or an employee of the taxpayer) is based on all information of which preparer

has any knowledge.

Signature of preparer if other than employee of the taxpayer

Date

______________________________________________________________________________

Print preparer's name

Signature of officer, member or partner

Date

______________________________________________________

NM CRS Identification number

________________________________________________________________________

FEIN

Title

Contact phone number

__________________________________________________________________

SSN or PTIN

_____________________________________________

Preparer's phone number

Taxpayer's E-mail address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2