Business Tax Return Form - City & Borough Of Yakutat

ADVERTISEMENT

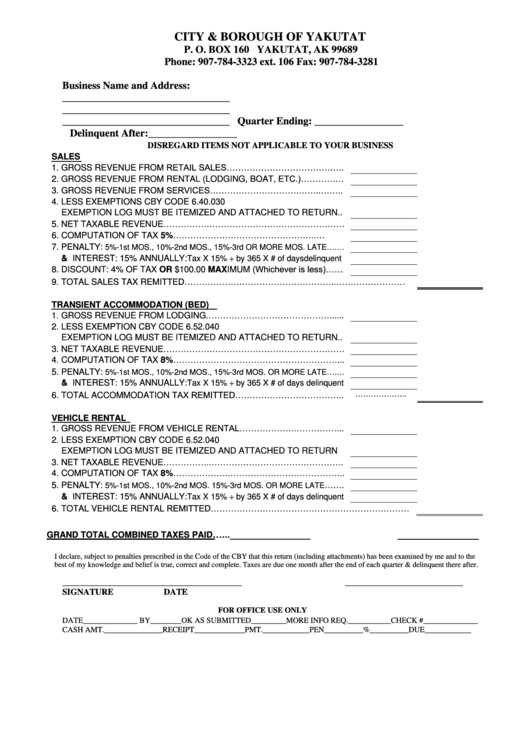

CITY & BOROUGH OF YAKUTAT

P. O. BOX 160 YAKUTAT, AK 99689

Phone: 907-784-3323 ext. 106 Fax: 907-784-3281

Business Name and Address:

________________________________

________________________________

________________________________

Quarter Ending: _________________

Delinquent After:_________________

DISREGARD ITEMS NOT APPLICABLE TO YOUR BUSINESS

SALES

1. GROSS REVENUE FROM RETAIL SALES…………………………………..

2. GROSS REVENUE FROM RENTAL (LODGING, BOAT, ETC.)……………

3. GROSS REVENUE FROM SERVICES………………………….……..……..

4. LESS EXEMPTIONS CBY CODE 6.40.030

EXEMPTION LOG MUST BE ITEMIZED AND ATTACHED TO RETURN..

5. NET TAXABLE REVENUE………………………………………………………

6. COMPUTATION OF TAX 5%........…………………………………………..…

7. PENALTY:

5%-1st MOS., 10%-2nd MOS., 15%-3rd OR MORE MOS. LATE….…

& INTEREST: 15% ANNUALLY:

Tax X 15% ÷ by 365 X # of days delinquent

8. DISCOUNT: 4% OF TAX OR $100.00 MAXIMUM (Whichever is less)……

9. TOTAL SALES TAX REMITTED……………………………………………..……………………

TRANSIENT ACCOMMODATION (BED)

1. GROSS REVENUE FROM LODGING.……………………………………......

2. LESS EXEMPTION CBY CODE 6.52.040

EXEMPTION LOG MUST BE ITEMIZED AND ATTACHED TO RETURN..

3. NET TAXABLE REVENUE………………………………………………………

4. COMPUTATION OF TAX 8%…………………………………………………...

5. PENALTY:

5%-1st MOS., 10%-2nd MOS., 15%-3rd MOS. OR MORE LATE….…

& INTEREST: 15% ANNUALLY:

Tax X 15% ÷ by 365 X # of days delinquent

6. TOTAL ACCOMMODATION TAX REMITTED………………………………..

………………..

VEHICLE RENTAL

1. GROSS REVENUE FROM VEHICLE RENTAL……………….……………...

2. LESS EXEMPTION CBY CODE 6.52.040

EXEMPTION LOG MUST BE ITEMIZED AND ATTACHED TO RETURN

3. NET TAXABLE REVENUE……………..……………………………………….

4. COMPUTATION OF TAX 8%……………….…………………………………..

…….

5. PENALTY:

5%-1st MOS., 10%-2nd MOS. 15%-3rd MOS. OR MORE LATE

& INTEREST: 15% ANNUALLY:

Tax X 15% ÷ by 365 X # of days delinquent

6. TOTAL VEHICLE RENTAL REMITTED……………………………………………………………

…...

______________

GRAND TOTAL COMBINED TAXES PAID..................................................................

I declare, subject to penalties prescribed in the Code of the CBY that this return (including attachments) has been examined by me and to the

best of my knowledge and belief is true, correct and complete. Taxes are due one month after the end of each quarter & delinquent there after.

_________________________________________

___________________________

SIGNATURE

DATE

FOR OFFICE USE ONLY

DATE______________ BY________OK AS SUBMITTED_________MORE INFO REQ.___________CHECK #______________

CASH AMT._______________RECEIPT_____________PMT.____________PEN__________%__________DUE____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1