Another example is that the assignor has

Column (a) – Assignee name. Enter the

List the unused carryover credit amount

Manufacturers’ Investment Credits generated

corporation name that is receiving a credit

available for assignment separately for each

from assets placed in service prior to

assignment from the assignor.

taxable year a credit was generated. Also,

January 1, 2004. Those credits have not been

separately list the credit amount available for

Column (b) – Assignee California corporation

used and were carried forward and assigned in

assignment that is generated in the current

number or FEIN. Enter the California

the 2010 taxable year. Those credits will expire

taxable year. For example, if the assignor

corporation number or FEIN of the corporation

in the 2011 taxable year, based on the date that

(Corporation A) generated $3,000 of R&D

that is receiving the credit assignment. If

the assignor originally generated the credit.

credit in 2004, $6,000 of R&D credit in 2005,

the corporation has applied for but not yet

The credits will expire for the assignee in the

and $5,000 of R&D credit for the current

received the California corporation number or

2011 taxable year, unless the carryover period

taxable year, then each taxable year’s credit

FEIN, enter “Applied For” in column (b). If the

was extended by law.

amount would be separately listed in column (f)

corporation is a non-U.S. foreign corporation,

with the corresponding taxable year the credit

enter “Foreign” in column (b).

Specific Line Instructions

was generated in column (d). See the example

Column (c ) – Assignee principal business

below for how to report the credit assignment.

The assignor must complete the following

activity code. Enter the six digit PBA code of

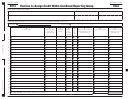

Column (g) – Credit amount assigned. Enter

information on form FTB 3544:

the assignee in column (c). See the Principal

the credit amount that is being assigned

Business Activity Codes chart inside the

• Key corporation name, California key

to an assignee in the combined reporting

Form 100 Tax Booklet or Form 100W Tax

corporation number, and key corporation

group. Using the same example listed under

Booklet for more information.

principal business activity (PBA) code.

column (f) above, Corporation A has $3,000

• Assignor name, assignor California

Column (d) – Taxable year credit was

available for assignment. Corporation A

corporation number or federal employer

generated. Enter the taxable year that the

assigned $1,000 to Corporation B and $2,000

identification number (FEIN), and assignor

assignor generated the credit. For example, the

to Corporation C in the current taxable

PBA code.

assignor (Corporation A) generated an R&D

year. Corporation A would enter the credit

credit of $1,000 during the 2006 taxable year.

For a complete list of the Principal Business

amount available for assignment of $3,000 in

The credit was not claimed by Corporation A

Activity Codes, get Form 100 Corporation

column (f), $1,000 assigned to Corporation B

and carried forward. On July 1, 2008, the

Tax Booklet or Form 100W Corporation Tax

in column (g), and the remaining credit balance

$1,000 credit was still available for use.

Booklet, Water’s-Edge Filers.

of $2,000 in column (h). On the next line,

Corporation A assigned the available credit to

Corporation A should carryover the amount of

Credit Assigned Information

Corporation F (another unitary member of the

$2,000 from the previous line of column (h)

combined reporting group) in the 2011 taxable

Enter the applicable credit name and credit

onto column (f). Then, Corporation A would

year. Corporation A will enter “2006” as the

code in the space provided. For a complete

enter $2,000 assigned to Corporation C in

taxable year the R&D credit was generated.

list of eligible credits (active or repealed with

column (g), with the remaining credit balance

a carryover provision) to be assigned, see the

Column (e) – Limitations. Check column (e) if

of $0 in column (h). See the example below for

Credit Chart inside the Form 100 Tax Booklet or

the credit assigned is subject to any limitations

how to report the credit assignment.

Form 100W Tax Booklet. Note: The Prior Year

as discussed under General Information C,

Column (h) – Balance available for use by

Alternative Minimum Tax credit is excluded

Disclosure of Limitations and Restrictions. If

assignor. This is the amount available for

from the list of credits eligible to be assigned.

the assigned credit is subject to any limitation,

assignment [column (f)] less the amount

attach a statement to form FTB 3544 fully

For each type of eligible business credit,

of the current taxable year assigned credit

disclosing the specific limitation(s) imposed

the assignor should complete a separate

[column (g)]. The balance is the credit amount

upon each of the assigned credits listed on

form FTB 3544. For example, if the assignor

available that the assignor may use to assign

the form. Assignor shall separately list credits

is assigning R&D credit and EZ credit, two

to another assignee, to offset the California tax

which are subject to separate and distinct

separate forms FTB 3544 are required.

liability, or to carry forward to future taxable

limitations and disclose each of those separate

years.

When completing the form, the assignor must

and distinct limitations in a statement.

separately list credits generated in different

Total credit assigned. Add amounts in

Column (f) – Credit amount available for

taxable years. Assignor shall separately list

column (g) and enter the total on this line. This

assignment. The available credit amount

credits which are subject to separate and

is the total credit amounts being assigned to

may be assigned to more than one assignee.

distinct limitations and disclose each of those

affiliated corporations that are members of the

However, once a credit amount is assigned

separate and distinct limitations in a statement

same combined reporting group.

to an assignee, the assignment is irrevocable

to be attached to this form.

Also, enter the total credit assigned on the

and the assigned credit amount cannot be

applicable line of the related credit form.

reassigned to another assignee.

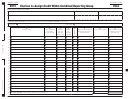

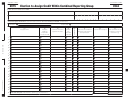

EXAMPLE – How to report the credit assignment. (This example does not reflect any credit used by the assignor).

*

(a)

(b)

(c)

(d)

(f)

(g)

(h)

(e)

Assignee name

Assignee

Assignee

Taxable

Credit amount

Credit amount

Balance

California

principal

year

available for

assigned

available for use

corporation

business

credit was

assignment

by assignor,

number or FEIN

activity code

generated

column (f) less

column (g)

**

Corp B

XXXXXXXXX

XXXXXX

2004

3,000

1,000

�,000

**

Corp C

Applied For

XXXXXX

2004

2,000

0

�,000

Corp B

XXXXXXXXX

XXXXXX

2005

6,000

1,500

4,500

Corp D

Foreign

XXXXXX

2005

4,500

2,500

2,000

Corp E

XXXXXXX

XXXXXX

2005

2,000

2,000

0

Corp E

XXXXXXX

XXXXXX

2011

5,000

5,000

0

Total credit assigned. Add amounts in column (g). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14,000

*

Check column (e) if the credit assigned is subject to limitations. See instructions.

**

The assignor can assign this available balance to another assignee as shown on the next line (Corp. C).

Page � FTB 3544 Instructions 2011

1

1 2

2 3

3