Clear

Print

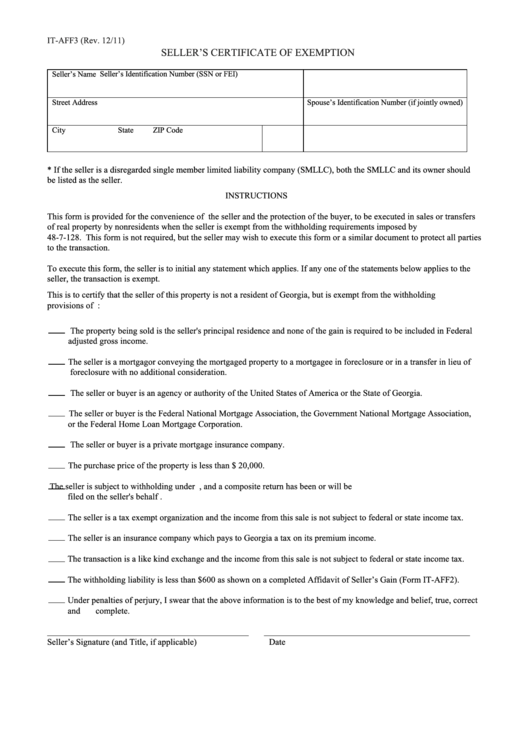

IT-AFF3 (Rev. 12/11)

SELLER’S CERTIFICATE OF EXEMPTION

Seller’s Identification Number (SSN or FEI)

Seller’s Name

Street Address

Spouse’s Identification Number (if jointly owned)

City

State

ZIP Code

* If the seller is a disregarded single member limited liability company (SMLLC), both the SMLLC and its owner should

be listed as the seller.

INSTRUCTIONS

This form is provided for the convenience of the seller and the protection of the buyer, to be executed in sales or transfers

of real property by nonresidents when the seller is exempt from the withholding requirements imposed by O.C.G.A. Section

48-7-128. This form is not required, but the seller may wish to execute this form or a similar document to protect all parties

to the transaction.

To execute this form, the seller is to initial any statement which applies. If any one of the statements below applies to the

seller, the transaction is exempt.

This is to certify that the seller of this property is not a resident of Georgia, but is exempt from the withholding

provisions of O.C.G.A. Section 48-7-128 by virtue of the following:

The property being sold is the seller's principal residence and none of the gain is required to be included in Federal

adjusted gross income.

The seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure or in a transfer in lieu of

foreclosure with no additional consideration.

The seller or buyer is an agency or authority of the United States of America or the State of Georgia.

The seller or buyer is the Federal National Mortgage Association, the Government National Mortgage Association,

or the Federal Home Loan Mortgage Corporation.

The seller or buyer is a private mortgage insurance company.

The purchase price of the property is less than $ 20,000.

The seller is subject to withholding under O.C.G.A. Section 48-7-129, and a composite return has been or will be

filed on the seller's behalf .

The seller is a tax exempt organization and the income from this sale is not subject to federal or state income tax.

The seller is an insurance company which pays to Georgia a tax on its premium income.

The transaction is a like kind exchange and the income from this sale is not subject to federal or state income tax.

The withholding liability is less than $600 as shown on a completed Affidavit of Seller’s Gain (Form IT-AFF2).

Under penalties of perjury, I swear that the above information is to the best of my knowledge and belief, true, correct

and complete.

______________________________________________

_______________________________________________

Seller’s Signature (and Title, if applicable)

Date

1

1