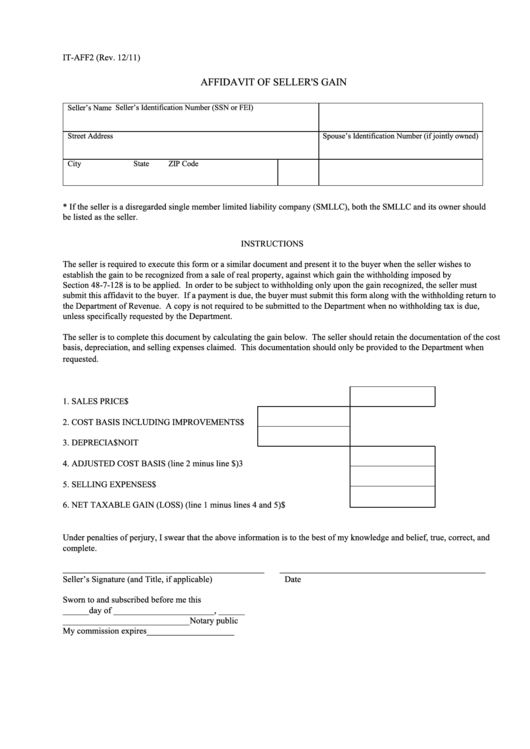

IT-AFF2 (Rev. 12/11)

Clear

Print

AFFIDAVIT OF SELLER'S GAIN

Seller’s Name

Seller’s Identification Number (SSN or FEI)

Street Address

Spouse’s Identification Number (if jointly owned)

City

State

ZIP Code

* If the seller is a disregarded single member limited liability company (SMLLC), both the SMLLC and its owner should

be listed as the seller.

INSTRUCTIONS

The seller is required to execute this form or a similar document and present it to the buyer when the seller wishes to

establish the gain to be recognized from a sale of real property, against which gain the withholding imposed by O.C.G.A.

Section 48-7-128 is to be applied. In order to be subject to withholding only upon the gain recognized, the seller must

submit this affidavit to the buyer. If a payment is due, the buyer must submit this form along with the withholding return to

the Department of Revenue. A copy is not required to be submitted to the Department when no withholding tax is due,

unless specifically requested by the Department.

The seller is to complete this document by calculating the gain below. The seller should retain the documentation of the cost

basis, depreciation, and selling expenses claimed. This documentation should only be provided to the Department when

requested.

1. SALES PRICE

$

2. COST BASIS INCLUDING IMPROVEMENTS $

3. DEPRECIA

I T

O

N

$

4. ADJUSTED COST BASIS (line 2 minus line

) 3

$

5. SELLING EXPENSES

$

6. NET TAXABLE GAIN (LOSS) (line 1 minus lines 4 and 5)

$

Under penalties of perjury, I swear that the above information is to the best of my knowledge and belief, true, correct, and

complete.

______________________________________________

_______________________________________________

Seller’s Signature (and Title, if applicable)

Date

Sworn to and subscribed before me this

______day of _______________________, ______

_____________________________Notary public

My commission expires____________________

1

1