Arizona Form 140a - Resident Personal Income Tax Return (Short Form) - 2011

ADVERTISEMENT

20

2011

20

2011

11

11

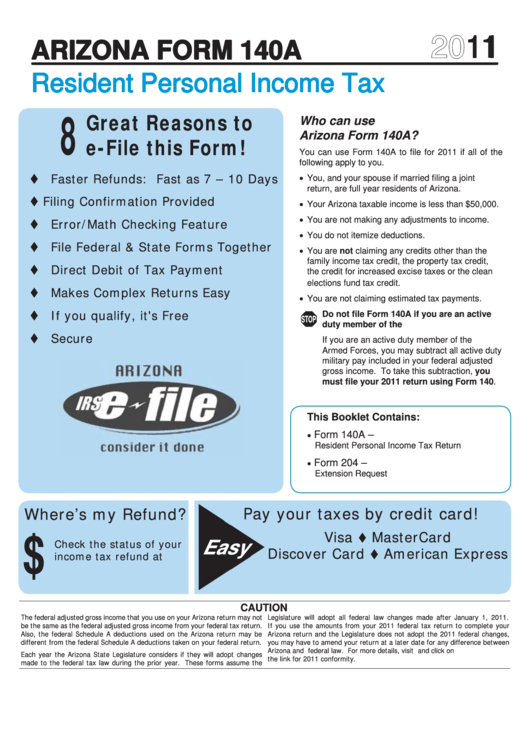

ARIZONA FORM 140A

ARIZONA FORM 140A

ARIZONA FORM 140A

ARIZONA FORM 140A

Resident Personal Income Tax

Resident Personal Income Tax

Resident Personal Income Tax

Resident Personal Income Tax

8

Great Reasons to

Who can use

Arizona Form 140A?

e-File this Form!

You can use Form 140A to file for 2011 if all of the

following apply to you.

Faster Refunds: Fast as 7 – 10 Days

You, and your spouse if married filing a joint

return, are full year residents of Arizona.

Filing Confirmation Provided

Your Arizona taxable income is less than $50,000.

You are not making any adjustments to income.

Error/Math Checking Feature

You do not itemize deductions.

File Federal & State Forms Together

You are not claiming any credits other than the

family income tax credit, the property tax credit,

Direct Debit of Tax Payment

the credit for increased excise taxes or the clean

elections fund tax credit.

Makes Complex Returns Easy

You are not claiming estimated tax payments.

If you qualify, it's Free

Do not file Form 140A if you are an active

STOP

duty member of the U.S. Armed Forces.

Secure

If you are an active duty member of the U.S.

Armed Forces, you may subtract all active duty

military pay included in your federal adjusted

gross income. To take this subtraction, you

must file your 2011 return using Form 140.

This Booklet Contains:

Form 140A –

Resident Personal Income Tax Return

Form 204 –

Extension Request

Pay your taxes by credit card!

Where’s my Refund?

$

Visa

MasterCard

Check the status of your

Easy

Discover Card

American Express

income tax refund at

CAUTION

The federal adjusted gross income that you use on your Arizona return may not

Legislature will adopt all federal law changes made after January 1, 2011.

be the same as the federal adjusted gross income from your federal tax return.

If you use the amounts from your 2011 federal tax return to complete your

Also, the federal Schedule A deductions used on the Arizona return may be

Arizona return and the Legislature does not adopt the 2011 federal changes,

different from the federal Schedule A deductions taken on your federal return.

you may have to amend your return at a later date for any difference between

Arizona and federal law. For more details, visit and click on

Each year the Arizona State Legislature considers if they will adopt changes

the link for 2011 conformity.

made to the federal tax law during the prior year. These forms assume the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33