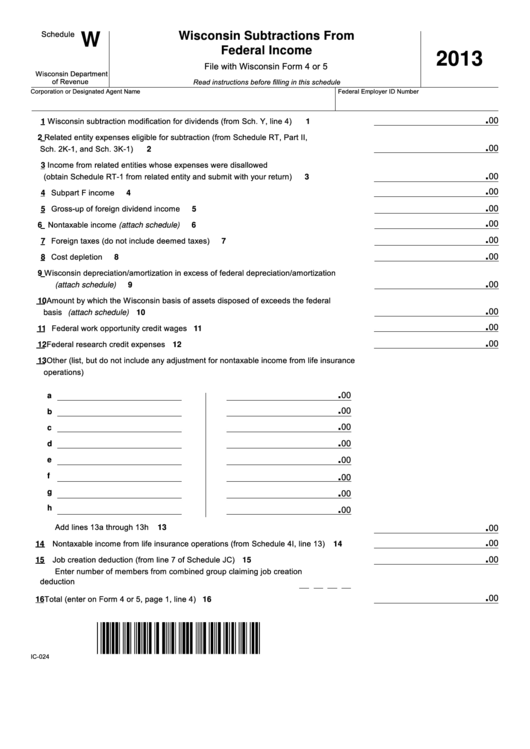

Schedule

Wisconsin Subtractions From

W

Federal Income

2013

File with Wisconsin Form 4 or 5

Wisconsin Department

of Revenue

Read instructions before filling in this schedule

Corporation or Designated Agent Name

Federal Employer ID Number

.

00

1 Wisconsin subtraction modification for dividends (from Sch. Y, line 4) . . . . . . . . . . . . .

1

2 Related entity expenses eligible for subtraction (from Schedule RT, Part II,

.

00

Sch. 2K-1, and Sch. 3K-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Income from related entities whose expenses were disallowed

.

00

(obtain Schedule RT-1 from related entity and submit with your return) . . . . . . . . . . . .

3

.

00

4 Subpart F income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

00

5 Gross-up of foreign dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

00

6 Nontaxable income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

00

7 Foreign taxes (do not include deemed taxes) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Cost depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Wisconsin depreciation/amortization in excess of federal depreciation/amortization

.

00

(attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Amount by which the Wisconsin basis of assets disposed of exceeds the federal

.

00

basis (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

00

11 Federal work opportunity credit wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

00

12 Federal research credit expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Other (list, but do not include any adjustment for nontaxable income from life insurance

operations)

.

00

a

.

00

b

.

00

c

.

00

d

.

00

e

.

00

f

.

00

g

.

00

h

Add lines 13a through 13h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

.

00

.

00

14 Nontaxable income from life insurance operations (from Schedule 4I, line 13) . . . . . . . 14

.

00

15 Job creation deduction (from line 7 of Schedule JC) . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Enter number of members from combined group claiming job creation

deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

00

16 Total (enter on Form 4 or 5, page 1, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

IC-024

1

1