Print Form

Clear Form

l

*110400110002*

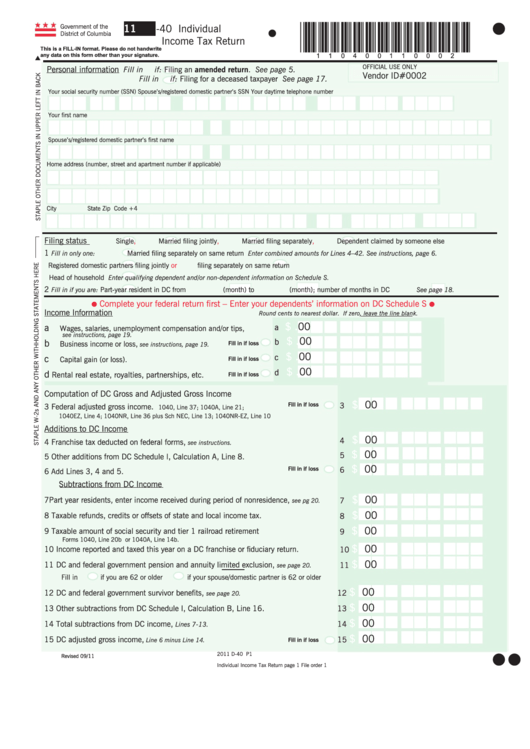

2011

D-40 Individual

Government of the

l

District of Columbia

Income Tax Return

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

s

OFFICIAL USE ONLY

Personal information

Fill in

if: Filing an amended return. See page 5.

Vendor ID#0002

Fill in

if: Filing for a deceased taxpayer See page 17.

Your social security number (SSN)

Spouse’s/registered domestic partner’s SSN

Your daytime telephone number

Your first name

M.I.

Last name

Spouse’s/registered domestic partner’s first name

M.I.

Last name

Home address (number, street and apartment number if applicable)

City

State

Zip Code +4

Filing status

Single,

Married filing

jointly,

Married filing

separately,

Dependent claimed by someone else

1

Fill in only one:

Married filing separately on same return

Enter combined amounts for Lines 4–42. See instructions, page 6.

Registered domestic partners filing jointly

or

filing separately on same return

Head of household

Enter qualifying dependent and/or non-dependent information on Schedule S.

2

Part-year resident in DC from

(month) to

(month); number of months in DC

Fill in if you are:

See page 18.

Complete your federal return first – Enter your dependents’ information on DC Schedule S

l

l

Income Information

Round cents to nearest dollar. If zero, leave the line blank.

.

$

00

a

a

Wages, salaries, unemployment compensation and/or tips,

see instructions, page 19.

.

$

00

b

b

Business income or loss,

Fill in if loss

see instructions, page 19.

.

$

00

c

c

Capital gain (or loss).

Fill in if loss

.

$

00

d

d

Rental real estate, royalties, partnerships, etc.

Fill in if loss

Computation of DC Gross and Adjusted Gross Income

.

$

00

Fill in if loss

3

3

Federal adjusted gross income.

1040, Line 37; 1040A, Line 21;

1040EZ, Line 4; 1040NR, Line 36 plus Sch NEC, Line 13; 1040NR-EZ, Line 10

Additions to DC Income

.

$

00

4

4

Franchise tax deducted on federal forms,

see instructions.

.

$

00

5

5

Other additions from DC Schedule I, Calculation A, Line 8.

.

$

00

Fill in if loss

6

6

Add Lines 3, 4 and 5.

Subtractions from DC Income

.

$

00

7

Part year residents, enter income received during period of nonresidence,

7

see pg 20.

.

$

00

8

Taxable refunds, credits or offsets of state and local income tax.

8

.

$

00

9

Taxable amount of social security and tier 1 railroad retirement

9

Forms 1040, Line 20b or 1040A, Line 14b.

.

$

00

10 Income reported and taxed this year on a DC franchise or fiduciary return.

10

.

$

00

11 DC and federal government pension and annuity limited exclusion,

11

see page 20.

Fill in

if you are 62 or older

if your spouse/domestic partner is 62 or older

.

$

00

12 DC and federal government survivor benefits,

12

see page 20.

.

$

00

13 Other subtractions from DC Schedule I, Calculation B, Line 16.

13

.

$

00

14 Total subtractions from DC income,

14

Lines 7-13.

.

$

00

15 DC adjusted gross income,

15

Line 6 minus Line 14.

Fill in if loss

l

l

2011 D-40 P1

Revised 09/11

Individual Income Tax Return page 1

File order 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11