Print

Clear

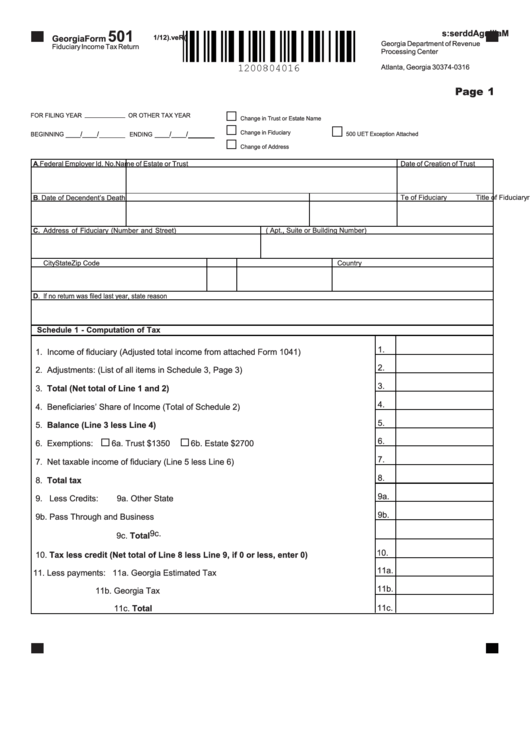

501

M

a

l i

n i

g

A

d

d

e r

s

s:

Georgia Form

(

R

e

. v

1/12)

Georgia Department of Revenue

Fiduciary Income Tax Return

Processing Center

P.O. Box 740316

Atlanta, Georgia 30374-0316

Page 1

FOR FILING YEAR

OR OTHER TAX YEAR

Change in Trust or Estate Name

Change in Fiduciary

____/____/

____/____/

500 UET Exception Attached

BEGINNING

ENDING

Change of Address

A. Federal Employer Id. No.

Name of Estate or Trust

Date of Creation of Trust

B.

Date of Decendent’s Death

N

a

m

e of Fiduciary

Title of Fiduciary

T

elephone No.

Address of Fiduciary (Number and Street)

( Apt., Suite or Building Number)

C.

City

State

Zip Code

Country

D.

If no return was filed last year, state reason

Schedule 1 - Computation of Tax

1.

1. Income of fiduciary (Adjusted total income from attached Form 1041)..............................

2.

2. Adjustments: (List of all items in Schedule 3, Page 3).......................................................

3.

3. Total (Net total of Line 1 and 2)....................................................................................

4.

4. Beneficiaries’ Share of Income (Total of Schedule 2)........................................................

5.

5. Balance (Line 3 less Line 4) .......................................................................... ....................

6.

6. Exemptions:

6a. Trust $1350

6b. Estate $2700 ................................................

7.

7. Net taxable income of fiduciary (Line 5 less Line 6)..........................................................

8.

8. Total tax.................................................................................................................. . ..........

9a.

9. Less Credits:

9a. Other State Credit..........................................................................

9b.

9b. Pass Through and Business Credits...........................................

9c.

9c. Total............................................................................................

10.

10. Tax less credit (Net total of Line 8 less Line 9, if 0 or less, enter 0)..........................

11a.

11. Less payments: 11a. Georgia Estimated Tax Paid..........................................................

11b.

11b. Georgia Tax Withheld.................................................................

11c.

11c. Total...........................................................................................

1

1 2

2 3

3 4

4 5

5 6

6