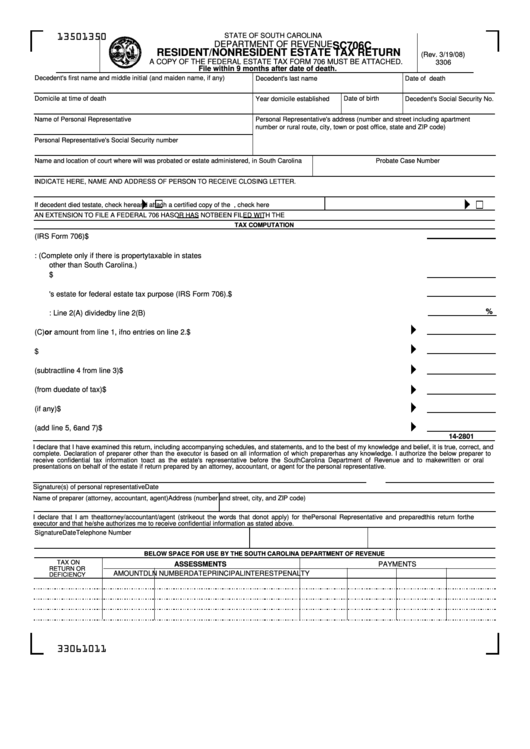

Form Sc706c - Resident/nonresident Estate Tax Return

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

SC706C

RESIDENT/NONRESIDENT ESTATE TAX RETURN

(Rev. 3/19/08)

A COPY OF THE FEDERAL ESTATE TAX FORM 706 MUST BE ATTACHED.

3306

File within 9 months after date of death.

Decedent's first name and middle initial (and maiden name, if any)

Decedent's last name

Date of death

Domicile at time of death

Date of birth

Year domicile established

Decedent's Social Security No.

Name of Personal Representative

Personal Representative's address (number and street including apartment

number or rural route, city, town or post office, state and ZIP code)

Personal Representative's Social Security number

Name and location of court where will was probated or estate administered, in South Carolina

Probate Case Number

INDICATE HERE, NAME AND ADDRESS OF PERSON TO RECEIVE CLOSING LETTER.

If decedent died testate, check here

and attach a certified copy of the will.

If form SC4768 is attached, check here

AN EXTENSION TO FILE A FEDERAL 706 HAS

OR HAS NOT

BEEN FILED WITH THE IRS. ATTACH A COPY OF THE REQUEST.

TAX COMPUTATION

1.

Total state death tax credit allowable for federal estate tax purposes (IRS Form 706)

$

2.

Proration of federal estate tax state death tax credit: (Complete only if there is property taxable in states

other than South Carolina.)

A.

Gross value for federal estate tax purposes of property taxable in South Carolina

$

B.

Gross value of decedent's estate for federal estate tax purpose (IRS Form 706).

$

%

C.

Percent of estate for federal estate tax purposes taxable in South Carolina: Line 2(A) divided by line 2(B)

3.

Tax payable to South Carolina. Line 1 multiplied by line 2(C) or amount from line 1, if no entries on line 2.

$

4.

Prior payments/extension requests

$

5.

Net estate tax (subtract line 4 from line 3)

$

6.

Interest (from due date of tax)

$

7.

Penalty (if any)

$

8.

Balance due (add line 5, 6 and 7)

$

14-2801

I declare that I have examined this return, including accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct, and

complete. Declaration of preparer other than the executor is based on all information of which preparer has any knowledge. I authorize the below preparer to

receive confidential tax information to act as the estate's representative before the South Carolina Department of Revenue and to make written or oral

presentations on behalf of the estate if return prepared by an attorney, accountant, or agent for the personal representative.

Signature(s) of personal representative

Date

Name of preparer (attorney, accountant, agent)

Address (number and street, city, and ZIP code)

I declare that I am the attorney/accountant/agent (strike out the words that do not apply) for the Personal Representative and prepared this return for the

executor and that he/she authorizes me to receive confidential information as stated above.

Signature

Date

Telephone Number

BELOW SPACE FOR USE BY THE SOUTH CAROLINA DEPARTMENT OF REVENUE

TAX ON

ASSESSMENTS

PAYMENTS

RETURN OR

AMOUNT

DLN NUMBER

DATE

PRINCIPAL

INTEREST

PENALTY

DEFICIENCY

33061011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2