Form I-41 - Nonresident Beneficiary Affidavit And Agreement Income Tax Withholding

ADVERTISEMENT

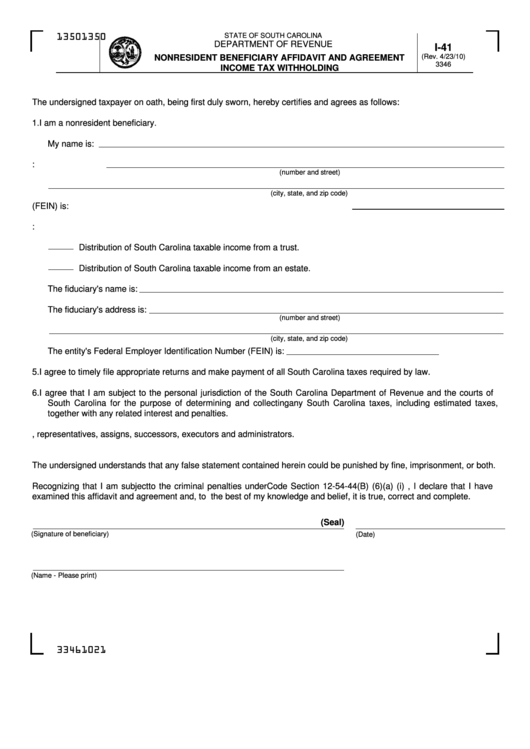

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

I-41

(Rev. 4/23/10)

NONRESIDENT BENEFICIARY AFFIDAVIT AND AGREEMENT

3346

INCOME TAX WITHHOLDING

The undersigned taxpayer on oath, being first duly sworn, hereby certifies and agrees as follows:

1. I am a nonresident beneficiary.

My name is:

2. My address is:

(number and street)

(city, state, and zip code)

3. My social security number or Federal Employer Identification Number (FEIN) is:

4. The type of income for which this affidavit and agreement applies is:

Distribution of South Carolina taxable income from a trust.

Distribution of South Carolina taxable income from an estate.

The fiduciary's name is:

The fiduciary's address is:

(number and street)

(city, state, and zip code)

The entity's Federal Employer Identification Number (FEIN) is:

5. I agree to timely file appropriate returns and make payment of all South Carolina taxes required by law.

6. I agree that I am subject to the personal jurisdiction of the South Carolina Department of Revenue and the courts of

South Carolina for the purpose of determining and collecting any South Carolina taxes, including estimated taxes,

together with any related interest and penalties.

7. This agreement will be binding upon my heirs, representatives, assigns, successors, executors and administrators.

The undersigned understands that any false statement contained herein could be punished by fine, imprisonment, or both.

Recognizing that I am subject to the criminal penalties under Code Section 12-54-44(B) (6) (a) (i) , I declare that I have

examined this affidavit and agreement and, to the best of my knowledge and belief, it is true, correct and complete.

(Seal)

(Signature of beneficiary)

(Date)

(Name - Please print)

33461021

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2