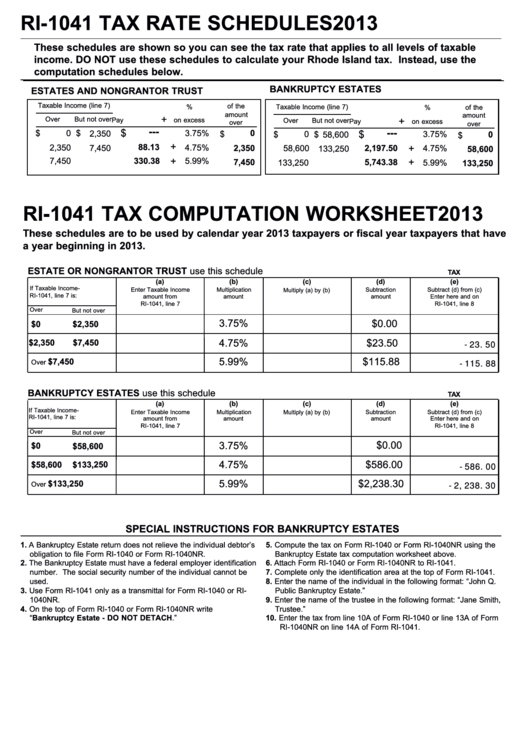

RI-1041 TAX RATE SCHEDULES

2013

These schedules are shown so you can see the tax rate that applies to all levels of taxable

income. DO NOT use these schedules to calculate your Rhode Island tax. Instead, use the

computation schedules below.

BANKRUPTCY ESTATES

ESTATES AND NONGRANTOR TRUST

Taxable Income (line 7)

%

of the

Taxable Income (line 7)

of the

%

amount

amount

+

Over

But not over

+

Pay

on excess

Over

But not over

Pay

on excess

over

over

---

$

---

$

0

$

3.75%

0

2,350

$

$

0

3.75%

0

$

$

58,600

$

+

2,350

88.13

4.75%

7,450

+

2,350

58,600

2,197.50

4.75%

133,250

58,600

7,450

..........

330.38

+

5.99%

7,450

133,250

..........

5,743.38

+

5.99%

133,250

RI-1041 TAX COMPUTATION WORKSHEET

2013

These schedules are to be used by calendar year 2013 taxpayers or fiscal year taxpayers that have

a year beginning in 2013.

ESTATE OR NONGRANTOR TRUST use this schedule

TAX

(a)

(b)

(c)

(d)

(e)

If Taxable Income-

Enter Taxable Income

Multiplication

Subtraction

Subtract (d) from (c)

Multiply (a) by (b)

RI-1041, line 7 is:

amount from

amount

amount

Enter here and on

RI-1041, line 7

RI-1041, line 8

Over

But not over

3.75%

$0.00

$0

$2,350

4.75%

$23.50

$2,350

$7,450

-23.50

$7,450

5.99%

$115.88

-115.88

Over

BANKRUPTCY ESTATES use this schedule

TAX

(a)

(b)

(c)

(d)

(e)

If Taxable Income-

Enter Taxable Income

Multiplication

Subtraction

Subtract (d) from (c)

Multiply (a) by (b)

RI-1041, line 7 is:

amount from

amount

amount

Enter here and on

RI-1041, line 7

RI-1041, line 8

Over

But not over

3.75%

$0.00

$0

$58,600

4.75%

$586.00

$58,600

-586.00

5.99%

$2,238.30

$133,250

-2,238.30

Over

SPECIAL INSTRUCTIONS FOR BANKRUPTCY ESTATES

1. A Bankruptcy Estate return does not relieve the individual debtor’s

5. Compute the tax on Form RI-1040 or Form RI-1040NR using the

obligation to file Form RI-1040 or Form RI-1040NR.

Bankruptcy Estate tax computation worksheet above.

2. The Bankruptcy Estate must have a federal employer identification

6. Attach Form RI-1040 or Form RI-1040NR to RI-1041.

number. The social security number of the individual cannot be

7. Complete only the identification area at the top of Form RI-1041.

used.

8. Enter the name of the individual in the following format: “John Q.

3. Use Form RI-1041 only as a transmittal for Form RI-1040 or RI-

Public Bankruptcy Estate.”

1040NR.

9. Enter the name of the trustee in the following format: “Jane Smith,

4. On the top of Form RI-1040 or Form RI-1040NR write

Trustee.”

“Bankruptcy Estate - DO NOT DETACH.”

10. Enter the tax from line 10A of Form RI-1040 or line 13A of Form

RI-1040NR on line 14A of Form RI-1041.

1

1