Instructions For Form Ta-2 - Transient Accommodations Tax Annual Return And Reconciliation

ADVERTISEMENT

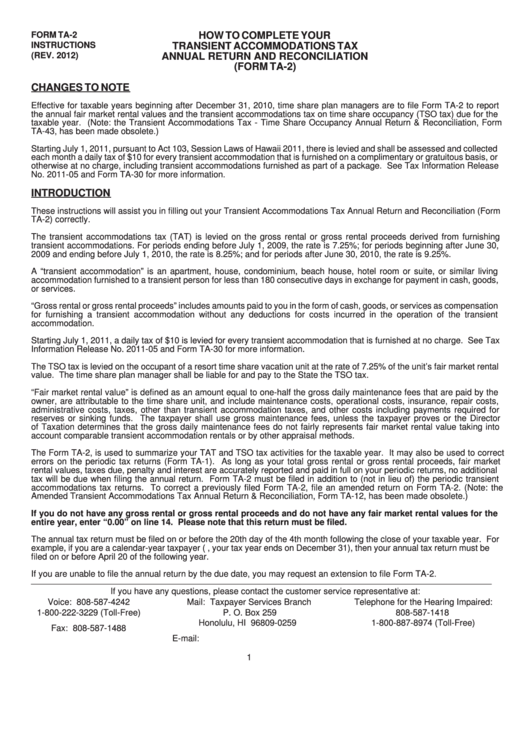

FORM TA-2

HOW TO COMPLETE YOUR

INSTRUCTIONS

TRANSIENT ACCOMMODATIONS TAX

(REV. 2012)

ANNUAL RETURN AND RECONCILIATION

(FORM TA-2)

CHANGES TO NOTE

Effective for taxable years beginning after December 31, 2010, time share plan managers are to file Form TA-2 to report

the annual fair market rental values and the transient accommodations tax on time share occupancy (TSO tax) due for the

taxable year. (Note: the Transient Accommodations Tax - Time Share Occupancy Annual Return & Reconciliation, Form

TA-43, has been made obsolete.)

Starting July 1, 2011, pursuant to Act 103, Session Laws of Hawaii 2011, there is levied and shall be assessed and collected

each month a daily tax of $10 for every transient accommodation that is furnished on a complimentary or gratuitous basis, or

otherwise at no charge, including transient accommodations furnished as part of a package. See Tax Information Release

No. 2011-05 and Form TA-30 for more information.

INTRODUCTION

These instructions will assist you in filling out your Transient Accommodations Tax Annual Return and Reconciliation (Form

TA-2) correctly.

The transient accommodations tax (TAT) is levied on the gross rental or gross rental proceeds derived from furnishing

transient accommodations. For periods ending before July 1, 2009, the rate is 7.25%; for periods beginning after June 30,

2009 and ending before July 1, 2010, the rate is 8.25%; and for periods after June 30, 2010, the rate is 9.25%.

A “transient accommodation” is an apartment, house, condominium, beach house, hotel room or suite, or similar living

accommodation furnished to a transient person for less than 180 consecutive days in exchange for payment in cash, goods,

or services.

“Gross rental or gross rental proceeds” includes amounts paid to you in the form of cash, goods, or services as compensation

for furnishing a transient accommodation without any deductions for costs incurred in the operation of the transient

accommodation.

Starting July 1, 2011, a daily tax of $10 is levied for every transient accommodation that is furnished at no charge. See Tax

Information Release No. 2011-05 and Form TA-30 for more information.

The TSO tax is levied on the occupant of a resort time share vacation unit at the rate of 7.25% of the unit’s fair market rental

value. The time share plan manager shall be liable for and pay to the State the TSO tax.

“Fair market rental value” is defined as an amount equal to one-half the gross daily maintenance fees that are paid by the

owner, are attributable to the time share unit, and include maintenance costs, operational costs, insurance, repair costs,

administrative costs, taxes, other than transient accommodation taxes, and other costs including payments required for

reserves or sinking funds. The taxpayer shall use gross maintenance fees, unless the taxpayer proves or the Director

of Taxation determines that the gross daily maintenance fees do not fairly represents fair market rental value taking into

account comparable transient accommodation rentals or by other appraisal methods.

The Form TA-2, is used to summarize your TAT and TSO tax activities for the taxable year. It may also be used to correct

errors on the periodic tax returns (Form TA-1). As long as your total gross rental or gross rental proceeds, fair market

rental values, taxes due, penalty and interest are accurately reported and paid in full on your periodic returns, no additional

tax will be due when filing the annual return. Form TA-2 must be filed in addition to (not in lieu of) the periodic transient

accommodations tax returns. To correct a previously filed Form TA-2, file an amended return on Form TA-2. (Note: the

Amended Transient Accommodations Tax Annual Return & Reconciliation, Form TA-12, has been made obsolete.)

If you do not have any gross rental or gross rental proceeds and do not have any fair market rental values for the

entire year, enter “0.00” on line 14. Please note that this return must be filed.

The annual tax return must be filed on or before the 20th day of the 4th month following the close of your taxable year. For

example, if you are a calendar-year taxpayer (i.e., your tax year ends on December 31), then your annual tax return must be

filed on or before April 20 of the following year.

If you are unable to file the annual return by the due date, you may request an extension to file Form TA-2.

_________________________________________________________________________________________________

If you have any questions, please contact the customer service representative at:

Voice: 808-587-4242

Mail: Taxpayer Services Branch

Telephone for the Hearing Impaired:

1-800-222-3229 (Toll-Free)

P. O. Box 259

808-587-1418

Honolulu, HI 96809-0259

1-800-887-8974 (Toll-Free)

Fax: 808-587-1488

E-mail: Taxpayer.Services@hawaii.gov

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8