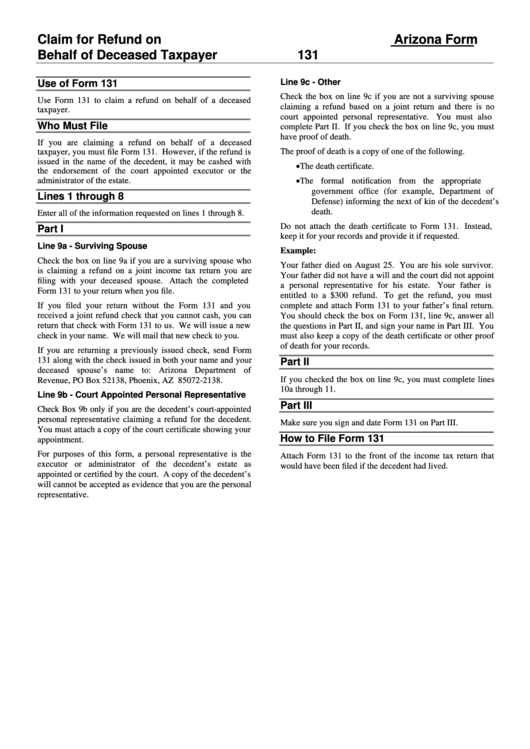

Instructions For Arizona Form 131 - Claim For Refund On Arizona Form Behalf Of Deceased Taxpayer

ADVERTISEMENT

Claim for Refund on

Arizona Form

Behalf of Deceased Taxpayer

131

Line 9c - Other

Use of Form 131

Check the box on line 9c if you are not a surviving spouse

Use Form 131 to claim a refund on behalf of a deceased

claiming a refund based on a joint return and there is no

taxpayer.

court appointed personal representative.

You must also

Who Must File

complete Part II. If you check the box on line 9c, you must

have proof of death.

If you are claiming a refund on behalf of a deceased

The proof of death is a copy of one of the following.

taxpayer, you must file Form 131. However, if the refund is

issued in the name of the decedent, it may be cashed with

The death certificate.

the endorsement of the court appointed executor or the

administrator of the estate.

The formal notification from the appropriate

government office (for example, Department of

Lines 1 through 8

Defense) informing the next of kin of the decedent’s

death.

Enter all of the information requested on lines 1 through 8.

Do not attach the death certificate to Form 131. Instead,

Part I

keep it for your records and provide it if requested.

Line 9a - Surviving Spouse

Example:

Check the box on line 9a if you are a surviving spouse who

Your father died on August 25. You are his sole survivor.

is claiming a refund on a joint income tax return you are

Your father did not have a will and the court did not appoint

filing with your deceased spouse. Attach the completed

a personal representative for his estate.

Your father is

Form 131 to your return when you file.

entitled to a $300 refund. To get the refund, you must

If you filed your return without the Form 131 and you

complete and attach Form 131 to your father’s final return.

received a joint refund check that you cannot cash, you can

You should check the box on Form 131, line 9c, answer all

return that check with Form 131 to us. We will issue a new

the questions in Part II, and sign your name in Part III. You

check in your name. We will mail that new check to you.

must also keep a copy of the death certificate or other proof

of death for your records.

If you are returning a previously issued check, send Form

131 along with the check issued in both your name and your

Part II

deceased spouse’s name to: Arizona Department of

If you checked the box on line 9c, you must complete lines

Revenue, PO Box 52138, Phoenix, AZ 85072-2138.

10a through 11.

Line 9b - Court Appointed Personal Representative

Part III

Check Box 9b only if you are the decedent’s court-appointed

personal representative claiming a refund for the decedent.

Make sure you sign and date Form 131 on Part III.

You must attach a copy of the court certificate showing your

How to File Form 131

appointment.

For purposes of this form, a personal representative is the

Attach Form 131 to the front of the income tax return that

executor or administrator of the decedent’s estate as

would have been filed if the decedent had lived.

appointed or certified by the court. A copy of the decedent’s

will cannot be accepted as evidence that you are the personal

representative.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1