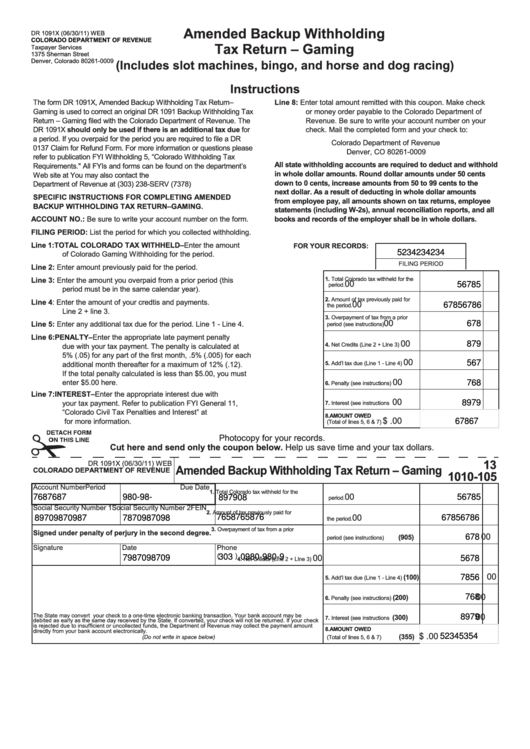

Amended Backup Withholding

DR

1091X (06/30/11) WEB

COLORADO DEPARTMENT OF REVENUE

Tax Return – Gaming

Taxpayer Services

1375 Sherman Street

Denver, Colorado 80261-0009

(Includes slot machines, bingo, and horse and dog racing)

Instructions

Line 8: Enter total amount remitted with this coupon. Make check

The form DR 1091X, Amended Backup Withholding Tax Return–

Gaming is used to correct an original DR 1091 Backup Withholding Tax

or money order payable to the Colorado Department of

Return – Gaming filed with the Colorado Department of Revenue. The

Revenue. Be sure to write your account number on your

DR 1091X should only be used if there is an additional tax due for

check. Mail the completed form and your check to:

a period. If you overpaid for the period you are required to file a DR

Colorado Department of Revenue

0137 Claim for Refund Form. For more information or questions please

Denver, CO 80261-0009

refer to publication FYI Withholding 5, “Colorado Withholding Tax

All state withholding accounts are required to deduct and withhold

Requirements." All FYIs and forms can be found on the department’s

in whole dollar amounts. Round dollar amounts under 50 cents

Web site at You may also contact the

down to 0 cents, increase amounts from 50 to 99 cents to the

Department of Revenue at (303) 238-SERV (7378)

next dollar. As a result of deducting in whole dollar amounts

SPECIFIC INSTRUCTIONS FOR COMPLETING AMENDED

from employee pay, all amounts shown on tax returns, employee

BACKUP WITHHOLDING TAX RETURN–GAMING.

statements (including W-2s), annual reconciliation reports, and all

ACCOUNT NO.: Be sure to write your account number on the form.

books and records of the employer shall be in whole dollars.

FILING PERIOD: List the period for which you collected withholding.

Line 1:

TOTAL COLORADO TAX WITHHELD–Enter the amount

FOR YOUR RECORDS:

5234234234

of Colorado Gaming Withholding for the period.

FILING PERIOD

Line 2: Enter amount previously paid for the period.

Line 3: Enter the amount you overpaid from a prior period (this

1. Total Colorado tax withheld for the

00

56785

period.

period must be in the same calendar year).

2. Amount of tax previously paid for

Line 4:

Enter the amount of your credtis and payments.

00

67856786

the period.

Line 2 + line 3.

3. Overpayment of tax from a prior

00

Line 5: Enter any additional tax due for the period. Line 1 - Line 4.

678

period (see instructions)

Line 6: PENALTY–Enter the appropriate late payment penalty

00

879

4. Net Credits (Line 2 + LIne 3)

due with your tax payment. The penalty is calculated at

5% (.05) for any part of the first month, .5% (.005) for each

00

567

additional month thereafter for a maximum of 12% (.12).

5. Add’l tax due (Line 1 - Line 4)

If the total penalty calculated is less than $5.00, you must

00

enter $5.00 here.

768

6. Penalty (see instructions)

Line 7: INTEREST–Enter the appropriate interest due with

00

your tax payment. Refer to publication FYI General 11,

8979

7. Interest (see instructions

“Colorado Civil Tax Penalties and Interest” at

8. AMOUNT OWED

$

.00

for more information.

67867

(Total of lines 5, 6 & 7)

Photocopy for your records.

Cut here and send only the coupon below. Help us save time and your tax dollars.

13

DR 1091X (06/30/11) WEB

Amended Backup Withholding Tax Return – Gaming

COLORADO DEPARTMENT OF REVENUE

1010-105

Account Number

Period

Due Date

1. Total Colorado tax withheld for the

00

7687687

980-98-

56785

897908

period.

Social Security Number 1

Social Security Number 2

FEIN

2. Amount of tax previously paid for

00

7658765876

89709870987

7870987098

67856786

the period.

3. Overpayment of tax from a prior

Signed under penalty of perjury in the second degree.

00

(905)

678

period (see instructions)

Signature

Date

Phone

(

)

00

303 0980-980-9

7987098709

5678

4. Net Credits (Line 2 + LIne 3)

00

(100)

7856

5. Add’l tax due (Line 1 - Line 4)

00

(200)

768

6. Penalty (see instructions)

00

The State may convert your check to a one-time electronic banking transaction. Your bank account may be

(300)

8979

7. Interest (see instructions

debited as early as the same day received by the State. If converted, your check will not be returned. If your check

is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount

8. AMOUNT OWED

directly from your bank account electronically.

$

.00

(355)

52345354

(Do not write in space below)

(Total of lines 5, 6 & 7)

1

1