Form Dr 0204 - Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax - 2011

ADVERTISEMENT

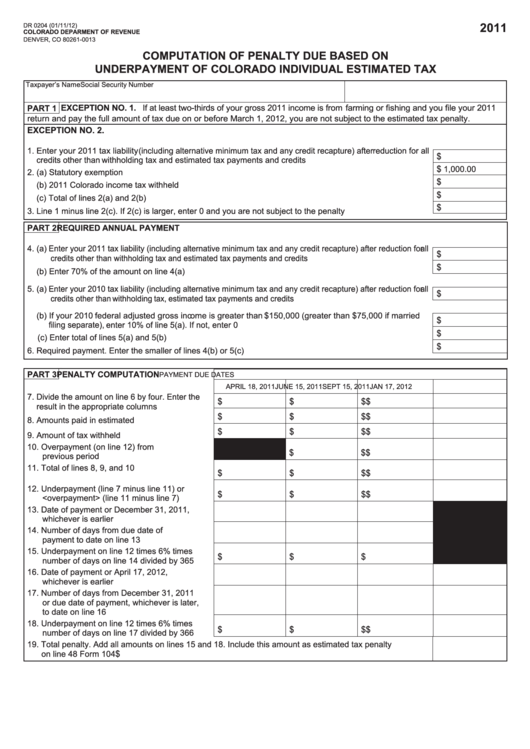

2011

DR 0204 (01/11/12)

COLORADO DEPARMENT OF REVENUE

DENVER, CO 80261-0013

COMPUTATION OF PENALTY DUE BASED ON

UNDERPAYMENT OF COLORADO INDIVIDUAL ESTIMATED TAX

Taxpayer’s Name

Social Security Number

PART 1 EXCEPTION NO. 1. If at least two-thirds of your gross 2011 income is from farming or fishing and you file your 2011

return and pay the full amount of tax due on or before March 1, 2012, you are not subject to the estimated tax penalty.

EXCEPTION NO. 2.

1. Enter your 2011 tax liability (including alternative minimum tax and any credit recapture) after reduction for all

$

credits other than withholding tax and estimated tax payments and credits .....................................................

$

1,000.00

2. (a) Statutory exemption ....................................................................................................................................

$

(b) 2011 Colorado income tax withheld .............................................................................................................

$

(c) Total of lines 2(a) and 2(b) ...........................................................................................................................

$

3. Line 1 minus line 2(c). If 2(c) is larger, enter 0 and you are not subject to the penalty .....................................

PART 2 REQUIRED ANNUAL PAYMENT

4. (a) Enter your 2011 tax liability (including alternative minimum tax and any credit recapture) after reduction for all

$

credits other than withholding tax and estimated tax payments and credits .....................................................

$

(b) Enter 70% of the amount on line 4(a) ..........................................................................................................

5. (a) Enter your 2010 tax liability (including alternative minimum tax and any credit recapture) after reduction for all

$

credits other than withholding tax, estimated tax payments and credits ..........................................................

(b) If your 2010 federal adjusted gross income is greater than $150,000 (greater than $75,000 if married

$

filing separate), enter 10% of line 5(a). If not, enter 0 ...................................................................................

$

(c) Enter total of lines 5(a) and 5(b) ..................................................................................................................

$

6. Required payment. Enter the smaller of lines 4(b) or 5(c) .................................................................................

PART 3 PENALTY COMPUTATION

PAYMENT DUE DATES

APRIL 18, 2011

JUNE 15, 2011

SEPT 15, 2011

JAN 17, 2012

7. Divide the amount on line 6 by four. Enter the

$

$

$

$

result in the appropriate columns ......................

$

$

$

$

8. Amounts paid in estimated tax...........................

$

$

$

$

9. Amount of tax withheld ......................................

10. Overpayment (on line 12) from

$

$

$

previous period ...............................................

11. Total of lines 8, 9, and 10

$

$

$

$

........................................................................

12. Underpayment (line 7 minus line 11) or

$

$

$

$

<overpayment> (line 11 minus line 7) .............

13. Date of payment or December 31, 2011,

whichever is earlier .........................................

14. Number of days from due date of

payment to date on line 13 ..............................

15. Underpayment on line 12 times 6% times

$

$

$

number of days on line 14 divided by 365 ......

16. Date of payment or April 17, 2012,

whichever is earlier .........................................

17. Number of days from December 31, 2011

or due date of payment, whichever is later,

to date on line 16 ............................................

18. Underpayment on line 12 times 6% times

$

$

$

$

number of days on line 17 divided by 366 ......

19. Total penalty. Add all amounts on lines 15 and 18. Include this amount as estimated tax penalty

$

on line 48 Form 104 .........................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2