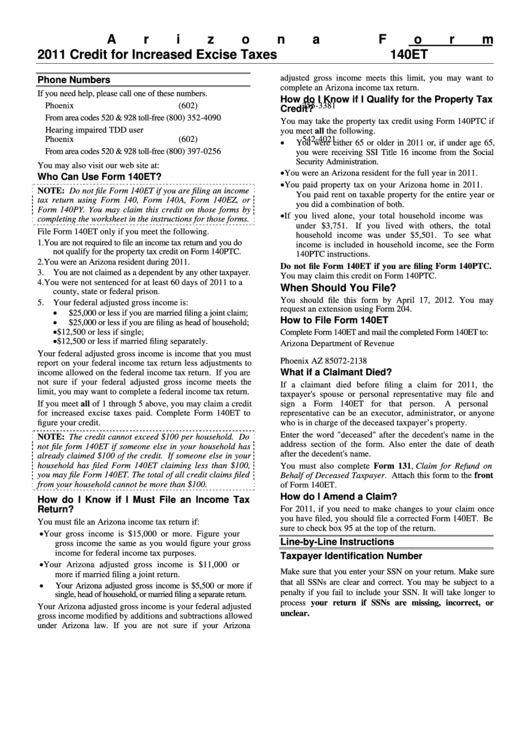

Instructions For Arizona Form 140et - Credit For Increased Excise Taxes - 2011

ADVERTISEMENT

Arizona Form

2011 Credit for Increased Excise Taxes

140ET

adjusted gross income meets this limit, you may want to

Phone Numbers

complete an Arizona income tax return.

If you need help, please call one of these numbers.

How do I Know if I Qualify for the Property Tax

Phoenix

(602) 255-3381

Credit?

From area codes 520 & 928 toll-free

(800) 352-4090

You may take the property tax credit using Form 140PTC if

Hearing impaired TDD user

you meet all the following.

Phoenix

(602) 542-4021

You were either 65 or older in 2011 or, if under age 65,

From area codes 520 & 928 toll-free

(800) 397-0256

you were receiving SSI Title 16 income from the Social

Security Administration.

You may also visit our web site at:

You were an Arizona resident for the full year in 2011.

Who Can Use Form 140ET?

You paid property tax on your Arizona home in 2011.

NOTE: Do not file Form 140ET if you are filing an income

You paid rent on taxable property for the entire year or

tax return using Form 140, Form 140A, Form 140EZ, or

you did a combination of both.

Form 140PY. You may claim this credit on those forms by

If you lived alone, your total household income was

completing the worksheet in the instructions for those forms.

under $3,751.

If you lived with others, the total

File Form 140ET only if you meet the following.

household income was under $5,501.

To see what

1.

You are not required to file an income tax return and you do

income is included in household income, see the Form

not qualify for the property tax credit on Form 140PTC.

140PTC instructions.

2.

You were an Arizona resident during 2011.

Do not file Form 140ET if you are filing Form 140PTC.

3.

You are not claimed as a dependent by any other taxpayer.

You may claim this credit on Form 140PTC.

4. You were not sentenced for at least 60 days of 2011 to a

When Should You File?

county, state or federal prison.

You should file this form by April 17, 2012. You may

5. Your federal adjusted gross income is:

request an extension using Form 204.

$25,000 or less if you are married filing a joint claim;

How to File Form 140ET

$25,000 or less if you are filing as head of household;

$12,500 or less if single;

Complete Form 140ET and mail the completed Form 140ET to:

$12,500 or less if married filing separately.

Arizona Department of Revenue

P.O. Box 52138

Your federal adjusted gross income is income that you must

Phoenix AZ 85072-2138

report on your federal income tax return less adjustments to

What if a Claimant Died?

income allowed on the federal income tax return. If you are

not sure if your federal adjusted gross income meets the

If a claimant died before filing a claim for 2011, the

limit, you may want to complete a federal income tax return.

taxpayer's spouse or personal representative may file and

If you meet all of 1 through 5 above, you may claim a credit

sign a Form 140ET for that person.

A personal

for increased excise taxes paid. Complete Form 140ET to

representative can be an executor, administrator, or anyone

figure your credit.

who is in charge of the deceased taxpayer’s property.

Enter the word "deceased" after the decedent's name in the

NOTE: The credit cannot exceed $100 per household. Do

address section of the form. Also enter the date of death

not file form 140ET if someone else in your household has

after the decedent's name.

already claimed $100 of the credit. If someone else in your

household has filed Form 140ET claiming less than $100,

You must also complete Form 131, Claim for Refund on

you may file Form 140ET. The total of all credit claims filed

Behalf of Deceased Taxpayer. Attach this form to the front

from your household cannot be more than $100.

of Form 140ET.

How do I Amend a Claim?

How do I Know if I Must File an Income Tax

Return?

For 2011, if you need to make changes to your claim once

you have filed, you should file a corrected Form 140ET. Be

You must file an Arizona income tax return if:

sure to check box 95 at the top of the return.

Your gross income is $15,000 or more. Figure your

Line-by-Line Instructions

gross income the same as you would figure your gross

income for federal income tax purposes.

Taxpayer Identification Number

Your Arizona adjusted gross income is $11,000 or

Make sure that you enter your SSN on your return. Make sure

more if married filing a joint return.

that all SSNs are clear and correct. You may be subject to a

Your Arizona adjusted gross income is $5,500 or more if

penalty if you fail to include your SSN. It will take longer to

single, head of household, or married filing a separate return.

process your return if SSNs are missing, incorrect, or

Your Arizona adjusted gross income is your federal adjusted

unclear.

gross income modified by additions and subtractions allowed

under Arizona law. If you are not sure if your Arizona

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3