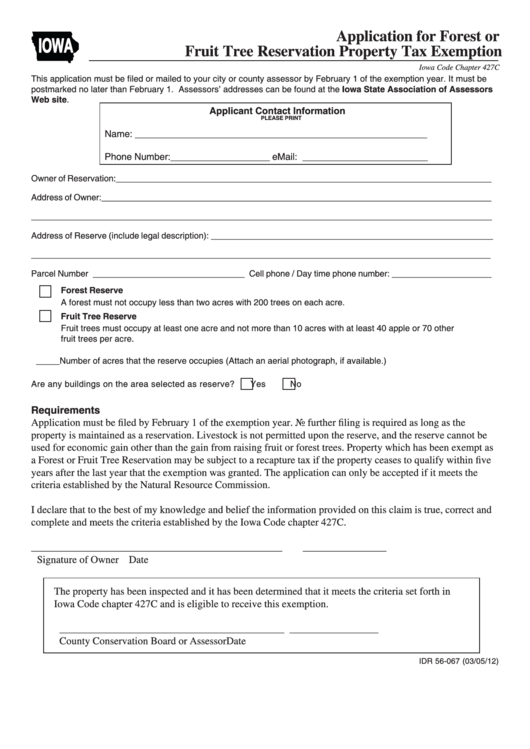

Form Idr 56-067 - Application For Forest Or Fruit Tree Reservation Property Tax Exemption

ADVERTISEMENT

Application for Forest or

IOWA

Fruit Tree Reservation Property Tax Exemption

Iowa Code Chapter 427C

This application must be filed or mailed to your city or county assessor by February 1 of the exemption year. It must be

postmarked no later than February 1. Assessors’ addresses can be found at the Iowa State Association of Assessors

Web site.

Applicant Contact Information

PLEASE PRINT

Name: ________________________________________________________

Phone Number:___________________ eMail: ________________________

Owner of Reservation:_______________________________________________________________________________

Address of Owner:__________________________________________________________________________________

___________________________________________________________________________________________________

Address of Reserve (include legal description): ___________________________________________________________

_________________________________________________________________________________________________

Parcel Number ________________________________ Cell phone / Day time phone number: _____________________

Forest Reserve

A forest must not occupy less than two acres with 200 trees on each acre.

Fruit Tree Reserve

Fruit trees must occupy at least one acre and not more than 10 acres with at least 40 apple or 70 other

fruit trees per acre.

_____ Number of acres that the reserve occupies (Attach an aerial photograph, if available.)

Are any buildings on the area selected as reserve?

Yes

No

Requirements

Application must be filed by February 1 of the exemption year. No further filing is required as long as the

property is maintained as a reservation. Livestock is not permitted upon the reserve, and the reserve cannot be

used for economic gain other than the gain from raising fruit or forest trees. Property which has been exempt as

a Forest or Fruit Tree Reservation may be subject to a recapture tax if the property ceases to qualify within five

years after the last year that the exemption was granted. The application can only be accepted if it meets the

criteria established by the Natural Resource Commission.

I declare that to the best of my knowledge and belief the information provided on this claim is true, correct and

complete and meets the criteria established by the Iowa Code chapter 427C.

________________________________________________

________________

Signature of Owner

Date

The property has been inspected and it has been determined that it meets the criteria set forth in

Iowa Code chapter 427C and is eligible to receive this exemption.

___________________________________________

_________________

County Conservation Board or Assessor

Date

IDR 56-067 (03/05/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1