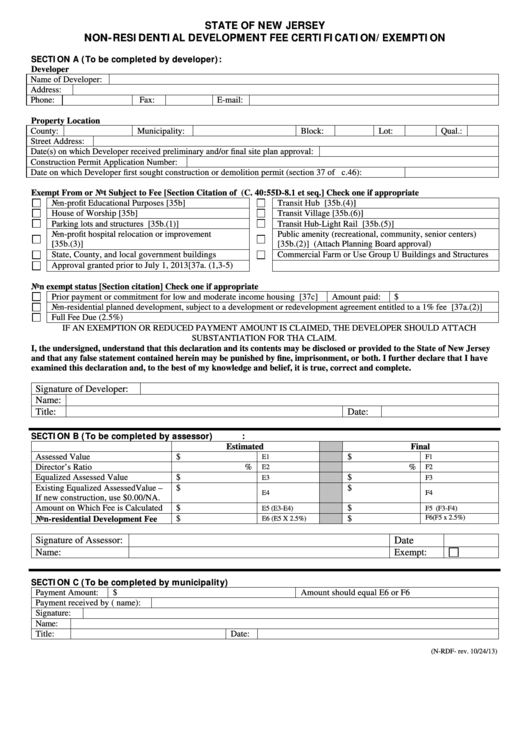

STATE OF NEW JERSEY

NON-RESIDENTIAL DEVELOPMENT FEE CERTIFICATION/EXEMPTION

SECTION A (To be completed by developer):

Developer

Name of Developer:

Address:

Phone:

Fax:

E-mail:

Property Location

County:

Municipality:

Block:

Lot:

Qual.:

Street Address:

Date(s) on which Developer received preliminary and/or final site plan approval:

Construction Permit Application Number:

Date on which Developer first sought construction or demolition permit (section 37 of P.L. 2008 c.46):

Exempt From or Not Subject to Fee [Section Citation of P.L. 2008 c. 46(C. 40:55D-8.1 et seq.] Check one if appropriate

Non-profit Educational Purposes [35b]

Transit Hub [35b.(4)]

House of Worship [35b]

Transit Village [35b.(6)]

Parking lots and structures [35b.(1)]

Transit Hub-Light Rail [35b.(5)]

Non-profit hospital relocation or improvement

Public amenity (recreational, community, senior centers)

[35b.(3)]

[35b.(2)] (Attach Planning Board approval)

State, County, and local government buildings

Commercial Farm or Use Group U Buildings and Structures

Approval granted prior to July 1, 2013 [37a. (1,3-5)

Non exempt status [Section citation] Check one if appropriate

Prior payment or commitment for low and moderate income housing [37c]

Amount paid:

$

Non-residential planned development, subject to a development or redevelopment agreement entitled to a 1% fee [37a.(2)]

Full Fee Due (2.5%)

IF AN EXEMPTION OR REDUCED PAYMENT AMOUNT IS CLAIMED, THE DEVELOPER SHOULD ATTACH

SUBSTANTIATION FOR THA CLAIM.

I, the undersigned, understand that this declaration and its contents may be disclosed or provided to the State of New Jersey

and that any false statement contained herein may be punished by fine, imprisonment, or both. I further declare that I have

examined this declaration and, to the best of my knowledge and belief, it is true, correct and complete.

Signature of Developer:

Name:

Title:

Date:

SECTION B (To be completed by assessor):

Estimated

Final

Assessed Value

$

$

E1

F1

Director’s Ratio

%

%

E2

F2

Equalized Assessed Value

$

$

E3

F3

Existing Equalized Assessed Value –

$

$

E4

F4

If new construction, use $0.00/NA.

Amount on Which Fee is Calculated

$

$

E5 (E3-E4)

F5 (F3-F4)

Non-residential Development Fee

$

$

E6 (E5 X 2.5%)

F6 (F5 x 2.5%)

Signature of Assessor:

Date

Name:

Exempt:

SECTION C (To be completed by municipality)

Payment Amount:

$

Amount should equal E6 or F6

Payment received by ( name):

Signature:

Name:

Title:

Date:

(N-RDF- rev. 10/24/13)

1

1 2

2