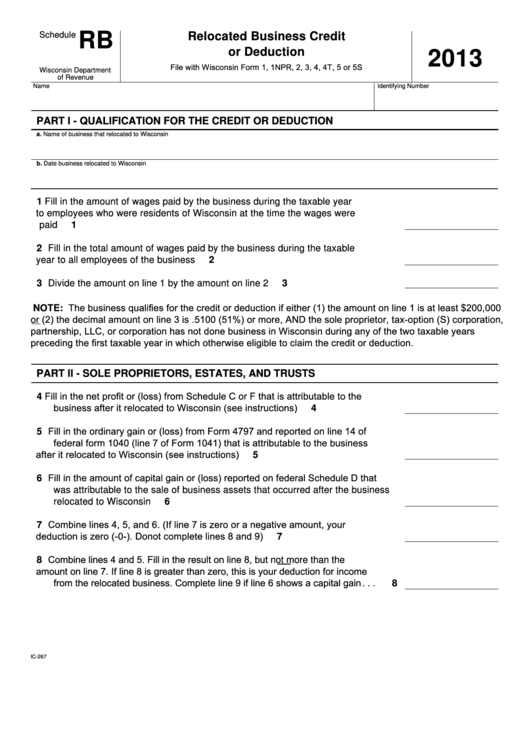

RB

Relocated Business Credit

Schedule

or Deduction

2013

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Wisconsin Department

of Revenue

Name

Identifying Number

PART I - QUALIFICATION FOR THE CREDIT OR DEDUCTION

a. Name of business that relocated to Wisconsin

b. Date business relocated to Wisconsin

1

Fill in the amount of wages paid by the business during the taxable year

to employees who were residents of Wisconsin at the time the wages were

paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Fill in the total amount of wages paid by the business during the taxable

year to all employees of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Divide the amount on line 1 by the amount on line 2 . . . . . . . . . . . . . . . . . . .

3

NOTE: The business qualifies for the credit or deduction if either (1) the amount on line 1 is at least $200,000

or (2) the decimal amount on line 3 is .5100 (51%) or more, AND the sole proprietor, tax-option (S) corporation,

partnership, LLC, or corporation has not done business in Wisconsin during any of the two taxable years

preceding the first taxable year in which otherwise eligible to claim the credit or deduction.

PART II - SOLE PROPRIETORS, ESTATES, AND TRUSTS

Fill in the net profit or (loss) from Schedule C or F that is attributable to the

4

business after it relocated to Wisconsin (see instructions) . . . . . . . . . . . . . . .

4

Fill in the ordinary gain or (loss) from Form 4797 and reported on line 14 of

5

federal form 1040 (line 7 of Form 1041) that is attributable to the business

after it relocated to Wisconsin (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

5

Fill in the amount of capital gain or (loss) reported on federal Schedule D that

6

was attributable to the sale of business assets that occurred after the business

relocated to Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Combine lines 4, 5, and 6. (If line 7 is zero or a negative amount, your

7

deduction is zero (-0-). Do not complete lines 8 and 9) . . . . . . . . . . . . . . . . . .

7

Combine lines 4 and 5. Fill in the result on line 8, but not more than the

8

amount on line 7. If line 8 is greater than zero, this is your deduction for income

from the relocated business. Complete line 9 if line 6 shows a capital gain . . .

8

IC-267

1

1 2

2