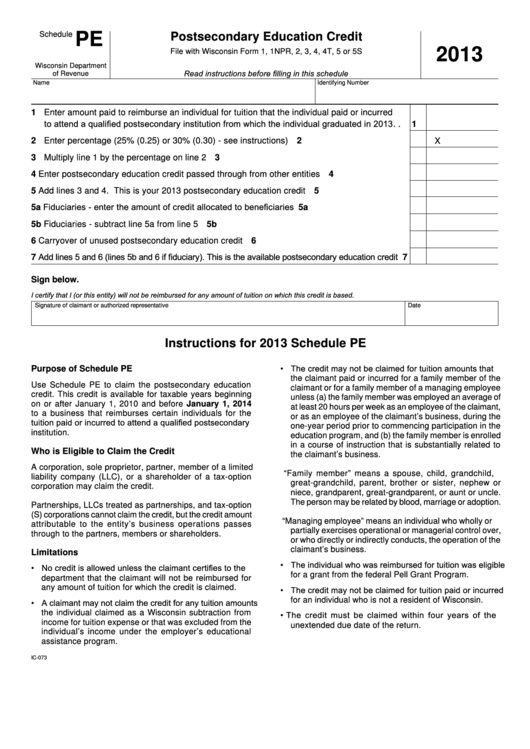

Schedule

PE

Postsecondary Education Credit

2013

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5 or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

1 Enter amount paid to reimburse an individual for tuition that the individual paid or incurred

to attend a qualified postsecondary institution from which the individual graduated in 2013 . . 1

2 Enter percentage (25% (0 .25) or 30% (0 .30) - see instructions) . . . . . . . . . . . . . . . . . . . . . . . 2

X

3 Multiply line 1 by the percentage on line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter postsecondary education credit passed through from other entities . . . . . . . . . . . . . . . . 4

5 Add lines 3 and 4 . This is your 2013 postsecondary education credit . . . . . . . . . . . . . . . . . . . 5

5a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . 5a

5b Fiduciaries - subtract line 5a from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

6 Carryover of unused postsecondary education credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Add lines 5 and 6 (lines 5b and 6 if fiduciary). This is the available postsecondary education credit

7

Sign below.

I certify that I (or this entity) will not be reimbursed for any amount of tuition on which this credit is based.

Signature of claimant or authorized representative

Date

Instructions for 2013 Schedule PE

• The credit may not be claimed for tuition amounts that

Purpose of Schedule PE

the claimant paid or incurred for a family member of the

Use Schedule PE to claim the postsecondary education

claimant or for a family member of a managing employee

credit . This credit is available for taxable years beginning

unless (a) the family member was employed an average of

on or after January 1, 2010 and before January 1, 2014

at least 20 hours per week as an employee of the claimant,

to a business that reimburses certain individuals for the

or as an employee of the claimant’s business, during the

tuition paid or incurred to attend a qualified postsecondary

one-year period prior to commencing participation in the

institution .

education program, and (b) the family member is enrolled

in a course of instruction that is substantially related to

Who is Eligible to Claim the Credit

the claimant’s business .

A corporation, sole proprietor, partner, member of a limited

“Family member” means a spouse, child, grandchild,

liability company (LLC), or a shareholder of a tax-option

great-grandchild, parent, brother or sister, nephew or

corporation may claim the credit .

niece, grandparent, great-grandparent, or aunt or uncle .

The person may be related by blood, marriage or adoption .

Partnerships, LLCs treated as partnerships, and tax-option

(S) corporations cannot claim the credit, but the credit amount

“Managing employee” means an individual who wholly or

attributable to the entity’s business operations passes

partially exercises operational or managerial control over,

through to the partners, members or shareholders .

or who directly or indirectly conducts, the operation of the

claimant’s business .

Limitations

• The individual who was reimbursed for tuition was eligible

• No credit is allowed unless the claimant certifies to the

for a grant from the federal Pell Grant Program .

department that the claimant will not be reimbursed for

any amount of tuition for which the credit is claimed .

• The credit may not be claimed for tuition paid or incurred

for an individual who is not a resident of Wisconsin .

• A claimant may not claim the credit for any tuition amounts

the individual claimed as a Wisconsin subtraction from

• The credit must be claimed within four years of the

income for tuition expense or that was excluded from the

unextended due date of the return .

individual’s income under the employer’s educational

assistance program .

IC-073

1

1 2

2