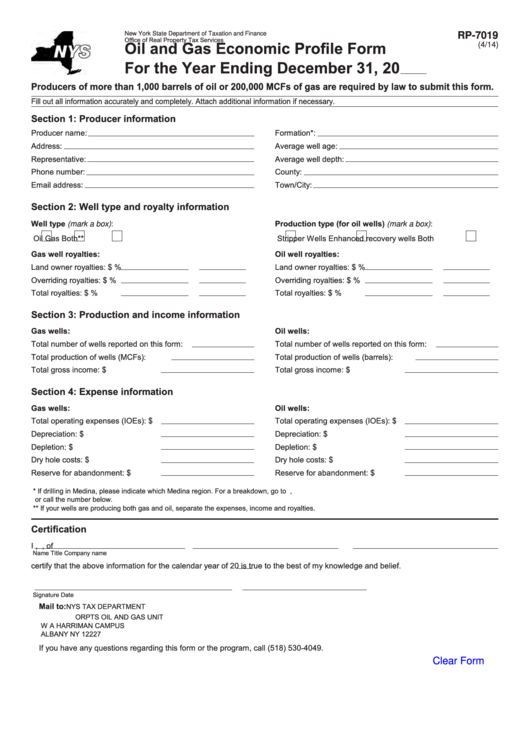

New York State Department of Taxation and Finance

RP-7019

Office of Real Property Tax Services

(4/14)

Oil and Gas Economic Profile Form

For the Year Ending December 31, 20

Producers of more than 1,000 barrels of oil or 200,000 MCFs of gas are required by law to submit this form.

Fill out all information accurately and completely. Attach additional information if necessary.

Section 1: Producer information

Producer name:

Formation*:

Address:

Average well age:

Representative:

Average well depth:

Phone number:

County:

Email address:

Town/City:

Section 2: Well type and royalty information

Well type (mark a box):

Production type (for oil wells) (mark a box):

Oil

Gas

Both**

Stripper Wells

Enhanced recovery wells

Both

Gas well royalties:

Oil well royalties:

Land owner royalties:

$

%

Land owner royalties:

$

%

Overriding royalties:

$

%

Overriding royalties:

$

%

Total royalties:

$

%

Total royalties:

$

%

Section 3: Production and income information

Gas wells:

Oil wells:

Total number of wells reported on this form:

Total number of wells reported on this form:

Total production of wells (MCFs):

Total production of wells (barrels):

Total gross income:

$

Total gross income:

$

Section 4: Expense information

Gas wells:

Oil wells:

Total operating expenses (IOEs):

$

Total operating expenses (IOEs):

$

Depreciation:

$

Depreciation:

$

Depletion:

$

Depletion:

$

Dry hole costs:

$

Dry hole costs:

$

Reserve for abandonment:

$

Reserve for abandonment:

$

* If drilling in Medina, please indicate which Medina region. For a breakdown, go to ,

or call the number below.

** If your wells are producing both gas and oil, separate the expenses, income and royalties.

Certification

I

,

, of

Name

Title

Company name

certify that the above information for the calendar year of 20

is true to the best of my knowledge and belief.

Signature

Date

Mail to:

NYS TAX DEPARTMENT

ORPTS OIL AND GAS UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

If you have any questions regarding this form or the program, call (518) 530-4049.

Clear Form

1

1