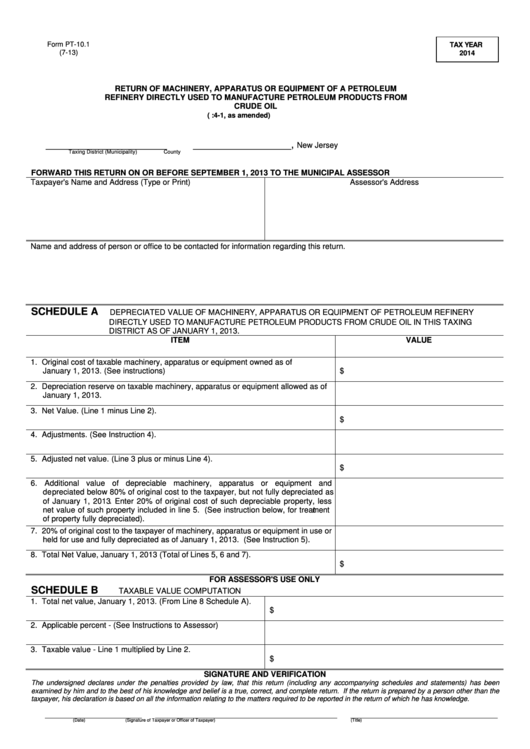

Form PT-10.1

TAX YEAR

(7-13)

2014

RETURN OF MACHINERY, APPARATUS OR EQUIPMENT OF A PETROLEUM

REFINERY DIRECTLY USED TO MANUFACTURE PETROLEUM PRODUCTS FROM

CRUDE OIL

(N.J.S.A. 54:4-1, as amended)

_____________________

_________________,

New Jersey

Taxing District (Municipality)

County

FORWARD THIS RETURN ON OR BEFORE SEPTEMBER 1, 2013 TO THE MUNICIPAL ASSESSOR

Taxpayer's Name and Address (Type or Print)

Assessor's Address

Name and address of person or office to be contacted for information regarding this return.

SCHEDULE A

DEPRECIATED VALUE OF MACHINERY, APPARATUS OR EQUIPMENT OF PETROLEUM REFINERY

DIRECTLY USED TO MANUFACTURE PETROLEUM PRODUCTS FROM CRUDE OIL IN THIS TAXING

DISTRICT AS OF JANUARY 1, 2013.

ITEM

VALUE

1. Original cost of taxable machinery, apparatus or equipment owned as of

January 1, 2013. (See instructions)

$

2. Depreciation reserve on taxable machinery, apparatus or equipment allowed as of

January 1, 2013.

3. Net Value. (Line 1 minus Line 2).

$

4. Adjustments. (See Instruction 4).

5. Adjusted net value. (Line 3 plus or minus Line 4).

$

6. Additional value of depreciable machinery, apparatus or equipment and

depreciated below 80% of original cost to the taxpayer, but not fully depreciated as

of January 1, 2013. Enter 20% of original cost of such depreciable property, less

net value of such property included in line 5. (See instruction below, for treatment

of property fully depreciated).

7. 20% of original cost to the taxpayer of machinery, apparatus or equipment in use or

held for use and fully depreciated as of January 1, 2013. (See Instruction 5).

8. Total Net Value, January 1, 2013 (Total of Lines 5, 6 and 7).

$

FOR ASSESSOR'S USE ONLY

SCHEDULE B

TAXABLE VALUE COMPUTATION

1. Total net value, January 1, 2013. (From Line 8 Schedule A).

$

2. Applicable percent - (See Instructions to Assessor)

3. Taxable value - Line 1 multiplied by Line 2.

$

SIGNATURE AND VERIFICATION

The undersigned declares under the penalties provided by law, that this return (including any accompanying schedules and statements) has been

examined by him and to the best of his knowledge and belief is a true, correct, and complete return. If the return is prepared by a person other than the

taxpayer, his declaration is based on all the information relating to the matters required to be reported in the return of which he has knowledge.

_________________________

_______________________________________________

______________________________________

(Date)

(Signature of Taxpayer or Officer of Taxpayer)

(Title)

_________________________

_______________________________________________

______________________________________

(Date)

(Signature of Individual or Firm Preparing Return)

(Address)

PENALTIES - TO AVOID PENALTIES EVERY TAXPAYER MUST FILE THIS RETURN WITH THE ASSESSOR

ON OR BEFORE SEPTEMBER 1, 2013. (See Instruction 8).

NOTICE:

This is the official form promulgated by the New Jersey Division of Taxation.

PT-10.1

1

1 2

2