Non-Cash Contribution Acknowledgement Letter Template

ADVERTISEMENT

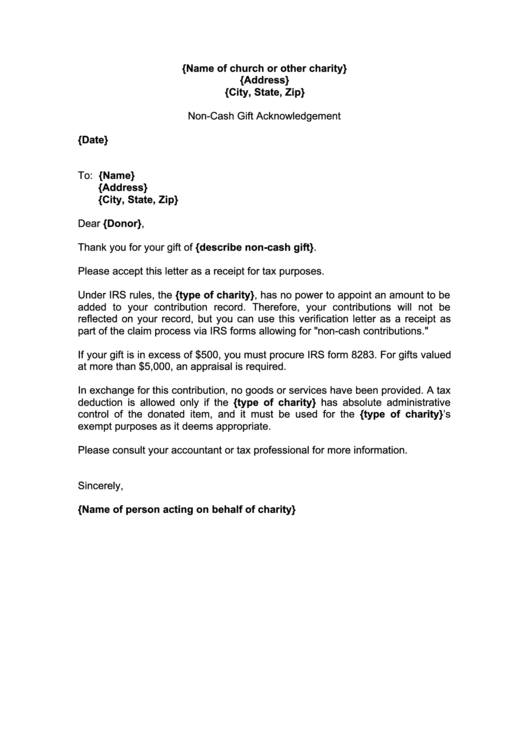

{Name of church or other charity}

{Address}

{City, State, Zip}

Non-Cash Gift Acknowledgement

{Date}

To: {Name}

{Address}

{City, State, Zip}

Dear {Donor},

Thank you for your gift of {describe non-cash gift}.

Please accept this letter as a receipt for tax purposes.

Under IRS rules, the {type of charity}, has no power to appoint an amount to be

added to your contribution record. Therefore, your contributions will not be

reflected on your record, but you can use this verification letter as a receipt as

part of the claim process via IRS forms allowing for "non-cash contributions."

If your gift is in excess of $500, you must procure IRS form 8283. For gifts valued

at more than $5,000, an appraisal is required.

In exchange for this contribution, no goods or services have been provided. A tax

deduction is allowed only if the {type of charity} has absolute administrative

control of the donated item, and it must be used for the {type of charity}’s

exempt purposes as it deems appropriate.

Please consult your accountant or tax professional for more information.

Sincerely,

{Name of person acting on behalf of charity}

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1