Form 88-002 - One-Time Registration Fee On Leased Vehicles Out-Of-State Credit Worksheet

ADVERTISEMENT

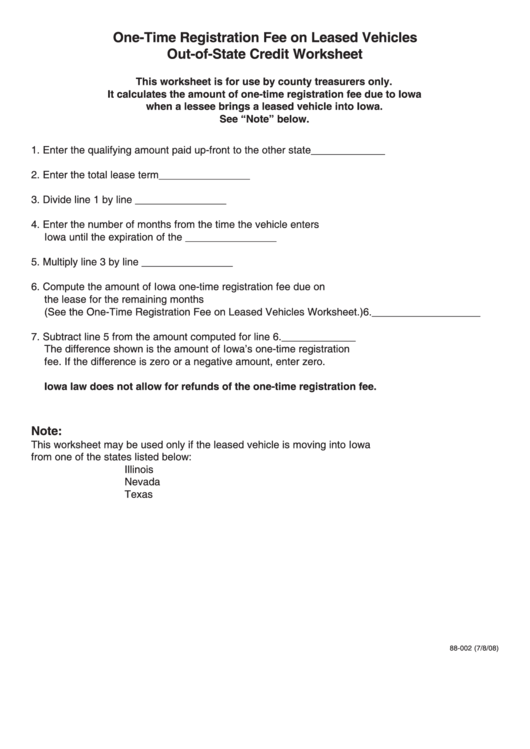

One-Time Registration Fee on Leased Vehicles

Out-of-State Credit Worksheet

This worksheet is for use by county treasurers only.

It calculates the amount of one-time registration fee due to Iowa

when a lessee brings a leased vehicle into Iowa.

See “Note” below.

1. Enter the qualifying amount paid up-front to the other state ................. 1. ___________________

2. Enter the total lease term ...................................................................... 2. ___________________

3. Divide line 1 by line 2 ............................................................................ 3. ___________________

4. Enter the number of months from the time the vehicle enters

Iowa until the expiration of the lease .................................................... 4. ___________________

5. Multiply line 3 by line 4 .......................................................................... 5. ___________________

6. Compute the amount of Iowa one-time registration fee due on

the lease for the remaining months

(See the One-Time Registration Fee on Leased Vehicles Worksheet.) 6. ___________________

7. Subtract line 5 from the amount computed for line 6. ............................ 7. ___________________

The difference shown is the amount of Iowa’s one-time registration

fee. If the difference is zero or a negative amount, enter zero.

Iowa law does not allow for refunds of the one-time registration fee.

Note:

This worksheet may be used only if the leased vehicle is moving into Iowa

from one of the states listed below:

Illinois

Nevada

Texas

88-002 (7/8/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1