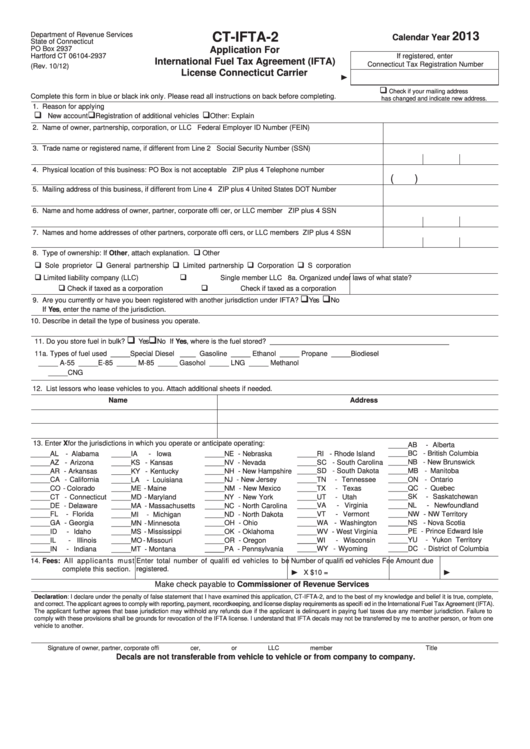

Form Ct-Ifta-2 - Application For International Fuel Tax Agreement (Ifta) License Connecticut Carrier - 2013

ADVERTISEMENT

2013

Department of Revenue Services

CT-IFTA-2

Calendar Year

State of Connecticut

PO Box 2937

Application For

Hartford CT 06104-2937

If registered, enter

International Fuel Tax Agreement (IFTA)

Connecticut Tax Registration Number

(Rev. 10/12)

License Connecticut Carrier

Check if your mailing address

Complete this form in blue or black ink only. Please read all instructions on back before completing.

has changed and indicate new address.

1. Reason for applying

New account

Registration of additional vehicles

Other: Explain

2. Name of owner, partnership, corporation, or LLC

Federal Employer ID Number (FEIN)

3. Trade name or registered name, if different from Line 2

Social Security Number (SSN)

4. Physical location of this business: PO Box is not acceptable

ZIP plus 4

Telephone number

(

)

5. Mailing address of this business, if different from Line 4

ZIP plus 4

United States DOT Number

6. Name and home address of owner, partner, corporate offi cer, or LLC member

ZIP plus 4

SSN

7. Names and home addresses of other partners, corporate offi cers, or LLC members

ZIP plus 4

SSN

8. Type of ownership: If Other, attach explanation.

Other

Sole proprietor

General partnership

Limited partnership

Corporation

S corporation

Limited liability company (LLC)

Single member LLC

8a. Organized under laws of what state?

Check if taxed as a corporation

Check if taxed as a corporation

9. Are you currently or have you been registered with another jurisdiction under IFTA?

Yes

No

If Yes, enter the name of the jurisdiction.

10. Describe in detail the type of business you operate.

11. Do you store fuel in bulk?

Yes

No

If Yes, where is the fuel stored? ______________________________________________

11a. Types of fuel used

_____ Special Diesel ____ Gasoline

_____ Ethanol

_____ Propane

_____Biodiesel

_____ A-55

_____ E-85

_____ M-85

_____ Gasohol

_____ LNG

_____ Methanol

_____CNG

12. List lessors who lease vehicles to you. Attach additional sheets if needed.

Name

Address

13. Enter X for the jurisdictions in which you operate or anticipate operating:

_____AB - Alberta

_____AL - Alabama

_____IA - Iowa

_____NE - Nebraska

_____RI

- Rhode Island

_____BC - British Columbia

_____NB - New Brunswick

_____AZ - Arizona

_____KS - Kansas

_____NV - Nevada

_____SC - South Carolina

_____MB - Manitoba

_____AR - Arkansas

_____KY - Kentucky

_____NH - New Hampshire

_____SD - South Dakota

_____TN - Tennessee

_____ON - Ontario

_____CA - California

_____LA - Louisiana

_____NJ - New Jersey

_____TX - Texas

_____QC - Quebec

_____CO - Colorado

_____ME - Maine

_____NM - New Mexico

_____CT - Connecticut

_____NY - New York

_____UT - Utah

_____SK - Saskatchewan

_____MD - Maryland

_____DE - Delaware

_____NC - North Carolina

_____VA - Virginia

_____NL - Newfoundland

_____MA - Massachusetts

_____FL - Florida

_____MI - Michigan

_____ND - North Dakota

_____VT - Vermont

_____NW - NW Territory

_____GA - Georgia

_____MN - Minnesota

_____OH - Ohio

_____WA - Washington

_____NS - Nova Scotia

_____PE - Prince Edward Isle

_____ID - Idaho

_____MS - Mississippi

_____OK - Oklahoma

_____WV - West Virginia

_____YU - Yukon Territory

_____IL

- Illinois

_____MO - Missouri

_____OR - Oregon

_____WI - Wisconsin

_____WY - Wyoming

_____DC - District of Columbia

_____IN - Indiana

_____MT - Montana

_____PA - Pennsylvania

14. Fees: All applicants must

Enter total number of qualifi ed vehicles to be

Number of qualifi ed vehicles

Fee

Amount due

complete this section.

registered.

X $10 =

Make check payable to Commissioner of Revenue Services

Declaration: I declare under the penalty of false statement that I have examined this application, CT-IFTA-2, and to the best of my knowledge and belief it is true, complete,

and correct. The applicant agrees to comply with reporting, payment, recordkeeping, and license display requirements as specifi ed in the International Fuel Tax Agreement (IFTA).

The applicant further agrees that base jurisdiction may withhold any refunds due if the applicant is delinquent in paying fuel taxes due any member jurisdiction. Failure to

comply with these provisions shall be grounds for revocation of the IFTA license. I understand that IFTA decals may not be transferred by me to another person, or from one

vehicle to another.

Signature of owner, partner, corporate offi cer, or LLC member

Title

Date

Decals are not transferable from vehicle to vehicle or from company to company.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2