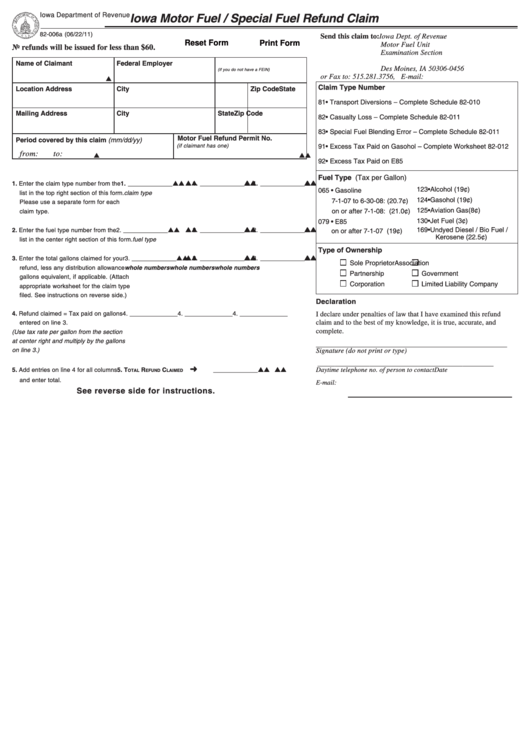

Iowa Motor Fuel / Special Fuel Refund Claim

Iowa Department of Revenue

82-006a (06/22/11)

Send this claim to: Iowa Dept. of Revenue

Reset Form

Print Form

Motor Fuel Unit

No refunds will be issued for less than $60.

Examination Section

P.O. Box 10456

Name of Claimant

Federal Employer I.D. No.

Social Security No.

Des Moines, IA 50306-0456

(if you do not have a FEIN)

or Fax to: 515.281.3756, E-mail: idrmotorfuel@iowa.gov

Claim Type Number

Location Address

City

State

Zip Code

81 • Transport Diversions – Complete Schedule 82-010

Mailing Address

City

State

Zip Code

82 • Casualty Loss – Complete Schedule 82-011

83 • Special Fuel Blending Error – Complete Schedule 82-011

Motor Fuel Refund Permit No.

Period covered by this claim (mm/dd/yy)

(if claimant has one)

91 • Excess Tax Paid on Gasohol – Complete Worksheet 82-012

from:

to:

92 • Excess Tax Paid on E85

Fuel Type (Tax per Gallon)

1. Enter the claim type number from the

1. _____________

1. _____________

1. _____________

123 • Alcohol (19¢)

065 • Gasoline

list in the top right section of this form.

claim type no.

claim type no.

claim type no.

124 • Gasohol (19¢)

7-1-07 to 6-30-08: (20.7¢)

Please use a separate form for each

125 • Aviation Gas (8¢)

on or after 7-1-08: (21.0¢)

claim type.

130 • Jet Fuel (3¢)

079 • E85

169 • Undyed Diesel / Bio Fuel /

2. Enter the fuel type number from the

2. _____________

2. _____________

2. _____________

on or after 7-1-07 (19¢)

Kerosene (22.5¢)

list in the center right section of this form.

fuel type no.

fuel type no.

fuel type no.

Type of Ownership

3. Enter the total gallons claimed for your

3. _____________

3. _____________

3. _____________

Sole Proprietor

Association

refund, less any distribution allowance

whole numbers

whole numbers

whole numbers

Partnership

Government

gallons equivalent, if applicable. (Attach

Corporation

Limited Liability Company

appropriate worksheet for the claim type

filed. See instructions on reverse side.)

Declaration

4. Refund claimed = Tax paid on gallons

4. ______________ 4. ______________ 4. ______________

I declare under penalties of law that I have examined this refund

entered on line 3.

claim and to the best of my knowledge, it is true, accurate, and

(Use tax rate per gallon from the section

complete.

at center right and multiply by the gallons

______________________________________________________

on line 3.)

Signature (do not print or type)

__________________________________

_________________

5. Add entries on line 4 for all columns

5. T

R

C

_____________

Daytime telephone no. of person to contact

Date

OTAL

EFUND

LAIMED

and enter total.

E-mail:

See reverse side for instructions.

1

1 2

2