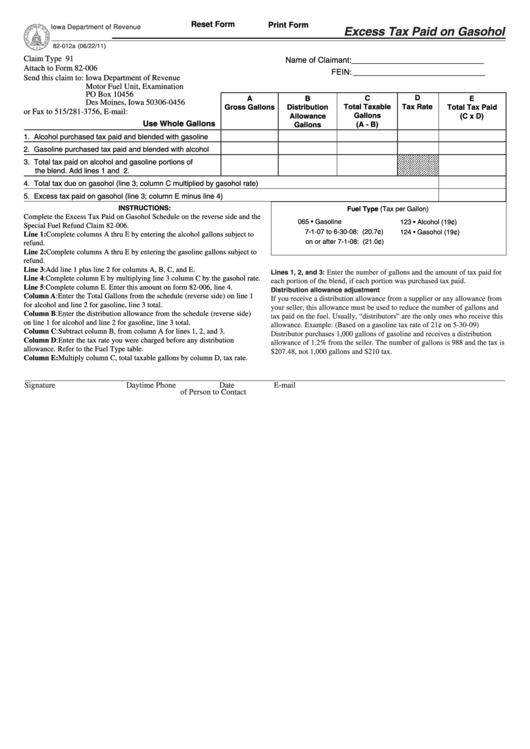

Reset Form

Print Form

Iowa Department of Revenue

Excess Tax Paid on Gasohol

82-012a (06/22/11)

Name of Claimant: ______________________________

Claim Type 91

Attach to Form 82-006

FEIN: ______________________________

Send this claim to: Iowa Department of Revenue

Motor Fuel Unit, Examination

PO Box 10456

D

C

A

B

E

Des Moines, Iowa 50306-0456

Total Taxable

Tax Rate

Gross Gallons

Distribution

Total Tax Paid

or Fax to 515/281-3756, E-mail: idrmotorfuel@iowa.gov

Gallons

Allowance

(C x D)

Use Whole Gallons

(A - B)

Gallons

1. Alcohol purchased tax paid and blended with gasoline

2. Gasoline purchased tax paid and blended with alcohol

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

3. Total tax paid on alcohol and gasoline portions of

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

the blend. Add lines 1 and 2.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

4. Total tax due on gasohol (line 3; column C multiplied by gasohol rate)

5. Excess tax paid on gasohol (line 3; column E minus line 4)

INSTRUCTIONS:

Fuel Type (Tax per Gallon)

Complete the Excess Tax Paid on Gasohol Schedule on the reverse side and the

065 • Gasoline

123 • Alcohol (19¢)

Special Fuel Refund Claim 82-006.

7-1-07 to 6-30-08: (20.7¢)

124 • Gasohol (19¢)

Line 1: Complete columns A thru E by entering the alcohol gallons subject to

on or after 7-1-08: (21.0¢)

refund.

Line 2: Complete columns A thru E by entering the gasoline gallons subject to

refund.

Line 3: Add line 1 plus line 2 for columns A, B, C, and E.

Lines 1, 2, and 3:

Enter the number of gallons and the amount of tax paid for

Line 4: Complete column E by multiplying line 3 column C by the gasohol rate.

each portion of the blend, if each portion was purchased tax paid.

Line 5: Complete column E. Enter this amount on form 82-006, line 4.

Distribution allowance adjustment

Column A: Enter the Total Gallons from the schedule (reverse side) on line 1

If you receive a distribution allowance from a supplier or any allowance from

for alcohol and line 2 for gasoline, line 3 total.

your seller, this allowance must be used to reduce the number of gallons and

Column B: Enter the distribution allowance from the schedule (reverse side)

tax paid on the fuel. Usually, “distributors” are the only ones who receive this

on line 1 for alcohol and line 2 for gasoline, line 3 total.

allowance. Example: (Based on a gasoline tax rate of 21¢ on 5-30-09)

Column C: Subtract column B, from column A for lines 1, 2, and 3.

Distributor purchases 1,000 gallons of gasoline and receives a distribution

Column D: Enter the tax rate you were charged before any distribution

allowance of 1.2% from the seller. The number of gallons is 988 and the tax is

allowance. Refer to the Fuel Type table.

$207.48, not 1,000 gallons and $210 tax.

Column E: Multiply column C, total taxable gallons by column D, tax rate.

Signature

Daytime Phone

Date

E-mail

of Person to Contact

1

1 2

2