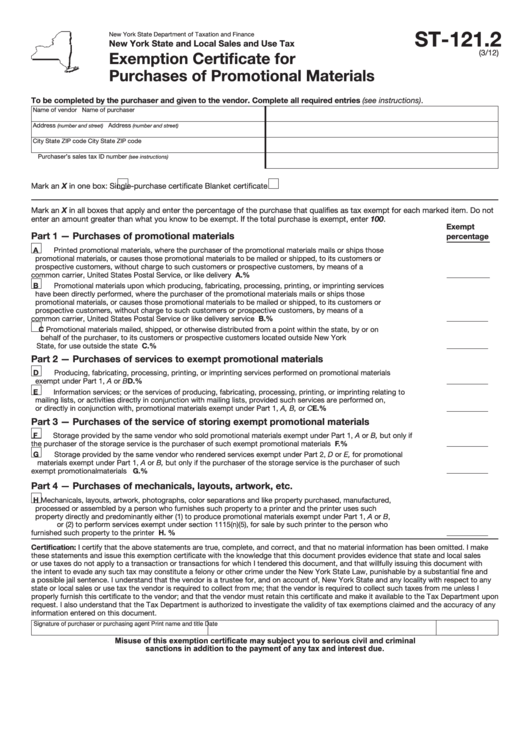

ST-121.2

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

(3/12)

Exemption Certificate for

Purchases of Promotional Materials

To be completed by the purchaser and given to the vendor. Complete all required entries (see instructions).

Name of vendor

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Purchaser’s sales tax ID number

(see instructions)

Mark an X in one box:

Single-purchase certificate

Blanket certificate

Mark an X in all boxes that apply and enter the percentage of the purchase that qualifies as tax exempt for each marked item. Do not

enter an amount greater than what you know to be exempt. If the total purchase is exempt, enter 100.

Exempt

Part 1 — Purchases of promotional materials

percentage

A Printed promotional materials, where the purchaser of the promotional materials mails or ships those

promotional materials, or causes those promotional materials to be mailed or shipped, to its customers or

prospective customers, without charge to such customers or prospective customers, by means of a

common carrier, United States Postal Service, or like delivery service....................................................................... A.

%

B Promotional materials upon which producing, fabricating, processing, printing, or imprinting services

have been directly performed, where the purchaser of the promotional materials mails or ships those

promotional materials, or causes those promotional materials to be mailed or shipped, to its customers or

prospective customers, without charge to such customers or prospective customers, by means of a

common carrier, United States Postal Service or like delivery service ....................................................................... B.

%

C Promotional materials mailed, shipped, or otherwise distributed from a point within the state, by or on

behalf of the purchaser, to its customers or prospective customers located outside New York

State, for use outside the state ................................................................................................................................... C.

%

Part 2 — Purchases of services to exempt promotional materials

D Producing, fabricating, processing, printing, or imprinting services performed on promotional materials

exempt under Part 1, A or B ........................................................................................................................................ D.

%

E Information services; or the services of producing, fabricating, processing, printing, or imprinting relating to

mailing lists, or activities directly in conjunction with mailing lists, provided such services are performed on,

or directly in conjunction with, promotional materials exempt under Part 1, A, B, or C ............................................. E.

%

Part 3 — Purchases of the service of storing exempt promotional materials

F Storage provided by the same vendor who sold promotional materials exempt under Part 1, A or B, but only if

the purchaser of the storage service is the purchaser of such exempt promotional materials ................................... F.

%

G Storage provided by the same vendor who rendered services exempt under Part 2, D or E, for promotional

materials exempt under Part 1, A or B, but only if the purchaser of the storage service is the purchaser of such

exempt promotional materials .................................................................................................................................... G.

%

Part 4 — Purchases of mechanicals, layouts, artwork, etc.

H Mechanicals, layouts, artwork, photographs, color separations and like property purchased, manufactured,

processed or assembled by a person who furnishes such property to a printer and the printer uses such

property directly and predominantly either (1) to produce promotional materials exempt under Part 1, A or B,

or (2) to perform services exempt under section 1115(n)(5), for sale by such printer to the person who

furnished such property to the printer ......................................................................................................................... H.

%

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make

these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales

or use taxes do not apply to a transaction or transactions for which I tendered this document, and that willfully issuing this document with

the intent to evade any such tax may constitute a felony or other crime under the New York State Law, punishable by a substantial fine and

a possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any locality with respect to any

state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect such taxes from me unless I

properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make it available to the Tax Department upon

request. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any

information entered on this document.

Signature of purchaser or purchasing agent

Print name and title

Date

Misuse of this exemption certificate may subject you to serious civil and criminal

sanctions in addition to the payment of any tax and interest due.

1

1 2

2